Worksheet for preparing a statement of cash flows

In accounting and finance, the term worksheet refers to a working paper that assists in preparing a final document. Its use is very common among accountants for preparing financial statements like income statement, balance sheet, statement of cash flows, etc. In this article, we will discuss a particular type of worksheet that accountants use while preparing the statement of cash flows.

Content:

The purpose and advantages of worksheet

The process of preparing a statement of cash flows involves the analysis of changes in non-cash balance sheet accounts. This process needs to be more formalized and documented when numerous adjustments and complications exist. A special worksheet serves this purpose.

A worksheet is neither a component of financial statements nor a part of the formal accounting record of the company. Its preparation is, therefore, not mandatory under any law or accounting framework. It is an optional tool that facilitates the assembly and classification of data for the construction of the statement of cash flows, which is an essential component of financial statements. The use of a worksheet assures a full explanation of the changes in balance sheet accounts and their net cash effects.

Format and sections of worksheet

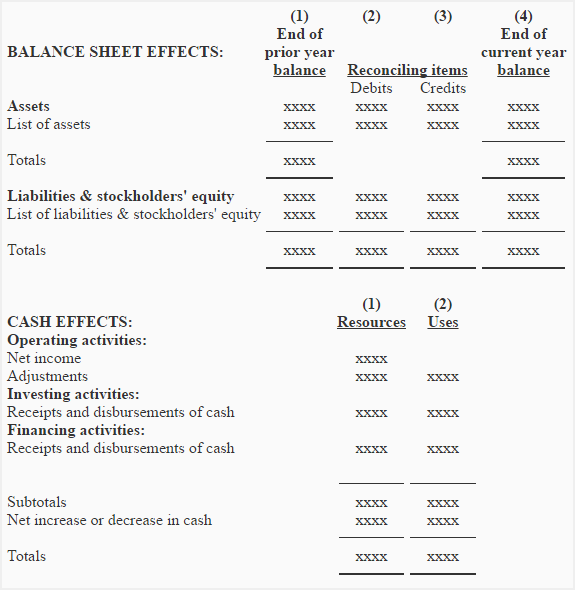

A worksheet for the statement of cash flows consists of two sections: a balance sheet effects section and a cash effects section. The balance sheet effects section is used to analyze the changes in account balances, and the cash effects section is used to collect information to be disclosed in the statement of cash flows. Before further explanation of these two sections, let’s view the skeleton format of the worksheet given below:

(1). The balance sheet effects section

The balance sheet effects section is the first section of the worksheet that explains the changes in all balance sheet account balances. To serve this purpose, this section makes use of four columns (see example below). The opening balances are listed in the first column, and the closing balances are listed in the fourth (last) column. The accounts with a debit balance are listed separately from those with a credit balance. The changes in all the balances are carefully computed and reconciled using accounting records and some additional information. These changes are then entered in the second and third (debit and credit) columns as appropriate. The amounts entered in the debit and credit columns explain the reasons for the changes in account balances. Therefore, they are also known as reconciling items or reconciling amounts. If all changes are correctly reconciled and recorded, the totals of the debit and credit columns will be equal.

(2). The cash effects section

The cash effects of the changes analyzed in the balance sheet effects section are written in the cash effects section. Cash effects are either inflows or outflows of cash. These inflows and outflows are classified as operating, investing, or financing cash flows. All inflows are listed in the resources column, and all outflows are listed in the uses column of this section. After carefully entering all changes with cash effects, the two columns are totaled and compared. The difference between the total amounts of resources and uses in the columns represents the net increase or decrease in cash during the period. This increase or decrease in cash must also be in agreement with the increase or decrease written in the cash line of the balance sheet effects section of the worksheet.

If completed accurately, the cash effects section provides complete information about the movement of cash required to be disclosed on the final statement of cash flows.

Example

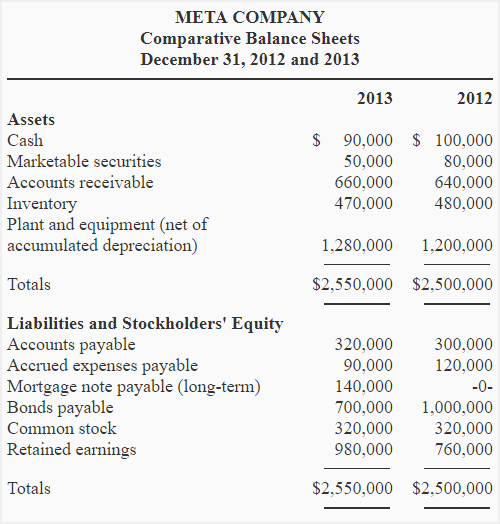

Meta Company is consistently using an indirect method for preparing its statement of cash flows. The comparative balance sheet and some additional information about the company are given below:

Additional information:

- Net income for the year 2013 was $500,000.

- The cash dividends of $280,000 were declared and paid during the year.

- Depreciation expenses for the year were $120,000.

- Sold marketable securities for $70,000; the cost was $30,000.

- Acquired plant assets for $200,000. $60,000 was paid in cash, and a mortgage note payable was issued for the balance.

Required:

- Prepare a worksheet as a helping tool for the preparation of the final statement of cash flows.

- Prepare a statement of cash flows of Meta Company.

Solution:

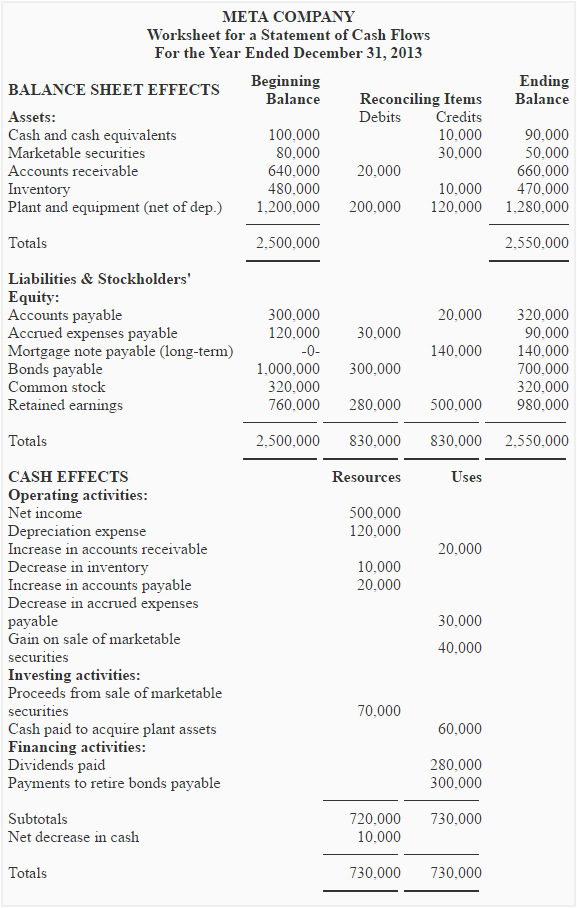

(1). Worksheet for the statement of cash flows:

Notice that the cash effects section provides all the information that we need to prepare the statement of cash flows under the indirect method.

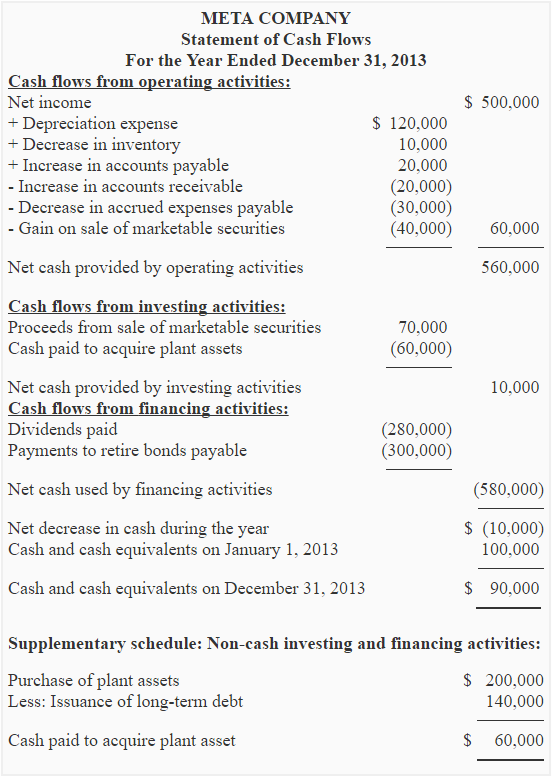

(2). Statement of cash flows:

Leave a comment