What is financial statement analysis?

Content:

- Definition and explanation

- Techniques of financial statement analysis

- Purpose

- Limitations

- Conclusion

Definition and explanation

Financial statement analysis is a function that involves the evaluation of reported financial statements of an entity, to aid stakeholders and users of those statements in their decision making. It seeks to establish relationships between various financial parameters so as to gain a better understanding of the entity’s financial health and performance. Financial statement analysis benefits both internal stakeholders (like management and existing shareholders) as well as external stakeholders (like potential investors, lenders and suppliers).

Financial statements typically include income statement, cash and fund flow statements and balance sheet. They record detailed financial transactions of the entity for a specific time period and thus reveal both financial performance and financial position of its business. A further analysis of these financial statements facilitates stakeholders with a lot of information which works as a key in their decision making process.

On the part of management, financial statement analysis reveals and identify areas of the organization that call for corrective actions, from investors’ perspective, it is a tool for gauging financial outlook and deciding upon the viability of their investment in the entity, and for vendors and suppliers, it helps dig into the entity’s creditworthiness and guides them in deciding whether or not they should consider providing goods and/or services to the entity on credit.

Techniques of financial statement analysis

While there are several techniques of financial statement analysis, the three most widely used techniques are briefly discussed below:

1. Horizontal analysis

Horizontal analysis involves evaluation of financial statements on a historical basis. Under this technique, financial data is compared across time periods. For example, the progression of sales is evaluated over the years to evaluate the sales growth rate of the entity.

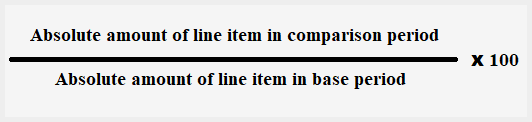

Horizontal analysis uses a base period and one or more comparison periods. The result of this analysis is generally expressed as a percentage with reference to the specified base period. The formula used to calculate percentages in a horizontal analysis is given below:

To understand the practical working of horizontal analysis, click here.

Benefits of horizontal analysis technique:

This technique of financial statement analysis offers the following advantages:

- Horizontal analysis helps identify and analyze trends and patterns in entity’s financial performance.

- By analyzing the progression of various financial parameters over the years, it helps in identifying areas of the strengths and weaknesses in the entity’s financial operations. For example, management can analyze the growth in entity’s profitability in relation to the growth in sales revenue over the years which may reveal actions needed to be taken towards cost control.

- This analysis provides a basis for estimating the entity’s future performance as well as assists in setting benchmarks or standards for forthcoming years.

Drawbacks of horizontal analysis technique:

Horizontal analysis technique also suffers from certain drawbacks; such as:

- It only compares relative financial performance without considering performance in absolute terms.

- Under this type of analysis, a change in classification of reported accounts can lead to misleading results.

- It can be manipulated to indicate desired but misleading results; for example, a comparison of line items amongst different quarters of the same year can lead to significantly different results when compared to the same quarter of different years.

2. Vertical analysis

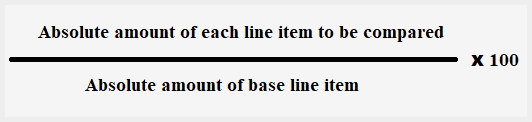

As the name suggests, vertical analysis involves the assessment of various line items of a financial statement as a percentage of a specific base line item. For example, various expenses on an income statement are expressed as a percentage of sales and the share of each type of asset is expressed as a percentage of total assets. The percentages under a vertical analysis are derived by the following formula:

To understand the practical working of vertical analysis, click here.

Benefits of vertical analysis technique:

- It is an easy representation of relationship between various line items of the financial statement.

- It helps understand the relative share of each line item. For example, if direct material is a significant percentage of sales in relation to say, direct labor, the management can understand its impact on profitability and can thus focus a greater attention towards any possibility of reducing or controlling it.

- Since a vertical analysis converts absolute numbers to percentage terms, It can be employed for inter-firm comparison with other entities within the industry by equating companies of different scales.

- It helps in identifying trends to aid comparison over time periods.

Drawbacks of vertical analysis technique:

- It requires a standard benchmark percentage defined for the analysis to be meaningful and to actually assist in decision making. For example, a company may know that its marketing expenses are 10% of its sales; however without a defined standard percentage, it may not be able to decide on the reasonableness of this derived percentage.

- Need for consistency in base – for an appropriate comparison from year to year or company to company, the base used for comparison must be the same.

3. Ratio analysis

Ratio analysis involves evaluating relationship between various line items of financial statements like income statement and balance sheet. This is done by calculating various financial ratios and comparing them with some set standards. On the basis of this comparison, management can take corrective steps and other stakeholders can make informed decisions according to their specific situations.

The ratios that are derived to perform a financial statement analysis are typically categorized as follows:

- Liquidity ratios: measure an entity’s ability to service its near-term debts as well as to meet its near-term fund requirements. A typical set of liquidity ratios includes current ratio, quick or liquid ratio, absolute liquid ratio, and current cash debt coverage ratio etc.

- Solvency ratios: measure the long-term stability of a business entity by evaluating its ability to meet its fund requirements over a long period of time. These typically include debt to equity ratio, fixed assets to equity ratio, current assets to equity ratio, and capital gearing ratio etc.

- Profitability ratios: measure the ability of a commercial entity to generate profits for its stockholders or owners. These ratios can include gross and net profit ratio, P/E ratio, EPS ratio, and return on capital employed ratio etc.

- Activity ratios: measure the efficiency of a business entity to utilize or convert its assets into sales revenue or liquid funds. These ratios can include inventory turnover ratio, receivables turnover ratio, and fixed assets turnover ratio etc.

Benefits of ratios analysis technique:

- Ratios analysis indicates an entity’s financial health as well as its operational efficiency through various parameters (e.g., liquidity and solvency) which other analysis techniques may not address.

- This analysis indicates the entity’s current position and any necessary remedial actions that it needs to take. It, thus, helps management in financial activity planning of the entity.

- Ratios analysis provides a standard for inter-firm comparison.

Drawbacks of ratios analysis technique:

- Ratios analysis can give erroneous results if there is a difference in accounting presentation of different entities compared or different periods considered in the analysis.

- Its results are often limited to quantitative analysis only, and not qualitative analysis. For example, balance sheet may exhibit a healthy current ratio but will not reveal the level of obsolescence present in the inventory considered in the calculation.

Purpose of financial statement analysis

Financial statement analysis has considerable utility for all stakeholders of an entity. Some of its salient purposes are mentioned below:

- The primary purpose: The primary purpose of performing a financial statement analysis is to dig into financial health as well as operational efficiency of the entity through its various analysis techniques.

- Aids industry comparison: It helps stakeholders gauge where the entity’s financial performance stands as compared to its peers in the industry. This is possible even when other entities operate at materially different scales.

- Aids historical comparison: It helps identify trends in financial performance as well as understand the financial progression of the entity over the years.

- Forecasting and budgeting: The interpretation of financial statement analysis can help management take budgeting decisions. Stakeholders can also estimate and project future performance based on results of financial analysis.

- Basis for decision making: The ultimate goal of the analysis is to provide stakeholders with a means to evaluate financial performance giving them a basis for comprehensive decision making.

Limitations of financial statement analysis

While financial statement analysis is an important and useful exercise, it does suffer from certain limitations. These can include:

- High dependency on accuracy of financial statements: A financial statement analysis can be inaccurate and in fact can even be manipulated if the base financial statements are inaccurate.

- Change in accounting policies: Any change in accounting methodology or presentation can result in erroneous results, hampering the efficacy of inter-period or inter-firm comparison.

- Focus on quantitative analysis: While exercising a financial statement analysis, the primary focus is on quantitative data. The non-monetary and qualitative aspects that impact financial performance are often side-lined under.

- Only a tool not a solution: The analysis of financial statements is only a means to an end. The actual success of the analysis requires expert analysts to meaningfully interpret, analyze and then take appropriate and timely decisions about the matters involved.

Conclusion

All in all, financial statement analysis is an extremely vital function as it has utility for both internal and external stakeholders. Generally, a large part of this financial analysis is presented in annual reports along with the reported financial statements. This is done so that the information is easily accessible by all stakeholders. However, a leader is only as good as his team; thus for financial statement analysis to be meaningful, the financial statements themselves must be accurate and the interpretations applied must be meaningful.

Leave a comment