What are current liabilities?

Content:

- Definition and explanation

- Examples of current liabilities

- Accounting/journal entries

- Presentation in balance sheet

- Analysis of current liabilities

Definition and explanation

Current liabilities refer to an entity’s short term financial obligations that are expected to be paid off within one year period or within a normal operating cycle, whichever is longer, either by using current assets or by creating some other current obligations. This is in contrast to the non-current or long-term liabilities that have distant due dates and don’t exhibit a claim on entity’s current resources.

Among others, the definition given above is considered much comprehensive and has a wider acceptance. It emphasizes the relationship between entity’s current assets and current liabilities and is much important to understand the working capital management. Also, it covers operating cycles of different length found in different industries.

What is an operating cycle?

The term operating cycle used in above definition refers to the period of time elapsing between the procurement of inventory and its conversion into cash through production, sales and collection from receivables. The length of operating cycle depends on the nature of business and industry to which the entity belongs. For example, entities in service and retail businesses mostly have more than one operating cycles in a single year. On the other hand, entities belonging to manufacturing and capital intensive industries may have operating cycles considerably longer than one year period. Operating cycle is sometimes known as cash conversion cycle of the entity.

Having adequate current resources in terms of both quantity and quality is crucial for a company to be able to honor its currently maturing obligations. Companies running with not enough current assets to payoff their current liabilities on time may possibly face hinderance in carrying out their day to day operations. For example, If accounts payable for materials and inputs are not settled within allowed credit period, vendors may limit or seize the supply of inputs to the company. The shortage of input inventory in a business may slow down and eventually halt its production lines.

Examples of current liabilities

The current liability accounts maintained by a business are largely impacted by the factors like government regulation and industry to which the entity belongs. The typical examples of current liabilities that can be found on an entity’s balance sheet are listed below:

- Accounts payable

- Notes payable

- Unearned revenue

- Interest payable

- Rent payable

- Dividends payable

- Sales tax payable

- Income tax payable

- Current portion of long term debt (CPLTD)

- Customers advances and deposits

Any other short term obligations that don’t relate to any of the above items or are not properly classifiable are put in an account known as “other current liabilities”. The balance in this account is reported as line item in the balance sheet along with above mentioned current liability items.

Accounting/journal entries for current liabilities

A current liability arises each time an entity receives an economic benefit for which the payment is to be met within one year period or within an operating cycle (which ever is longer). The liability is journalized by crediting a liability account and debiting an asset or expense account depending on the nature or type of benefit received by the entity.

For example, Mercedes Benz receives shipment of tyres from its vendor Yokohama for which it will pay $1,000,000 within next 60 days. Because Mercedes will not use all the tyres immediately in its car manufacturing process, its accountants will initially make an entry to record an asset and a liability by debiting inventory and crediting accounts payable for $1,000,000. When the payment will be made to Yokohama, the accountants at Mercedes will eliminate the liability of $1,000,000 by debiting accounts payable and crediting cash. Both the entries are given below:

Inventory….. $1,000,000 [Dr]

Accounts Payable….. $1,000,000 [Cr]

Accounts Payable….. $1,000,000 [Dr]

Cash….. $1,000,000 [Cr]

Disclosure of current liabilities – balance sheet presentation and supplemental information

Current liabilities are mostly reported in balance sheet at their maturity values and not at present values. Since the maturity period in case of current liabilities is mostly less than one year, the overstatement of these liabilities in balance sheet due to the difference between present value and maturity value is usually small and immaterial.

GAAP permits entities not to compute present values of payables resulting from transactions with suppliers in normal course of business if they are of short-term nature and do not exceed one year period.

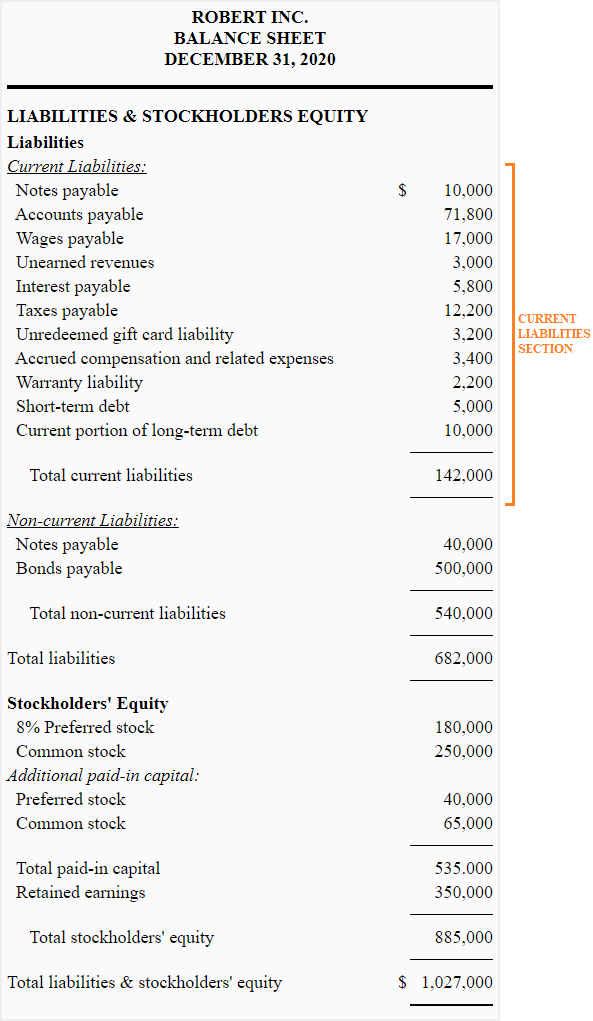

In balance sheet, the current liabilities form the first subsection under “Liabilities and Stockholders’ Equity Section. Within Current Liabilities Subsection, current liability accounts are listed in a certain logical order. For example, they can be listed in order of liquidation, in order of maturity or in descending order of amounts. However, many companies prefer to use the same order which they have already used for listing accounts in their chart of accounts. The following example illustrates how current liabilities might be presented by a company in its balance sheet:

International presentation and trends:

Non-current liabilities are often presented before current liabilities by the entities that prepare and report their financial statements under IFRS.

Entities must provide sufficient details and supplemental information regarding their current liabilities to satisfy the guidelines stated by full disclosure principle. The following points are notable in this regard:

- The secured liabilities and the assets pledged as collateral against them should be clearly identified.

- Companies can’t offset their current liabilities against assets that are available to liquidate those liabilities. Each item should be separately and explicitly reported.

- The details regarding extendable liabilities and their extended due dates must be disclosed.

- The current portion of a long term debt (i.e., current maturities of long term debt) must be classified and listed as current liability.

An exception to the presentation of current liabilities:

If a currently maturing obligation is to be paid using a long-term asset, the obligation should be reported in long-term or non-current liabilities section. Since the extinguishment of such obligation will not impact current assets, its inclusion in current liabilities section of balance sheet will impair the users’ understanding of actual working capital position of business.

In case a short term obligation is excluded from current liabilities due to its refinancing, the company should disclose it by providing the following information in notes to the financial statements:

- A comprehensive detail about the financing agreement.

- Details about the terms of new obligation that may arise as a result of refinancing.

- Details about the terms of equity security that may be issued for refinancing.

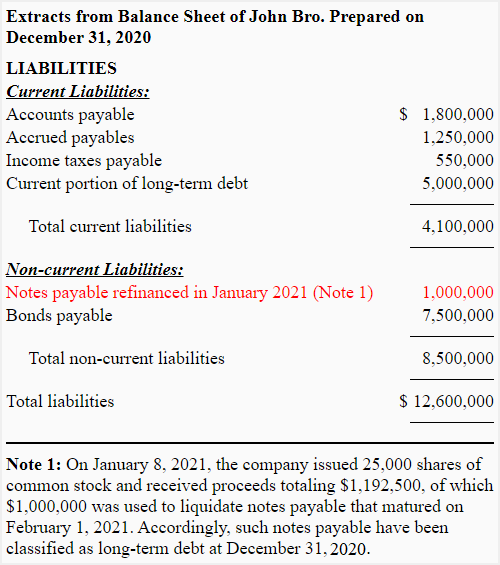

If a company highly expects that it will refinance a short-term obligation on long-term bases by issuing its equity security after balance sheet date, the obligation should be reported as non-current or long-term in its balance sheet. The following extracts from John Brother’s balance sheet illustrate the presentation of notes payable liability that the company will refinance by issuing its common stock:

Analysis of current liabilities

Understanding the basic distinction between current and non-current liabilities is helpful to know about an entity’s liquidity position. The liquidity of a business entity is determined by the quantity as well as quality of its current assets in relation to its current liabilities. The liquidity of a liability is determined by the expected amount of time to elapse before it is met.

Entities that own enough quality current assets and are able to pay all of their current liabilities on time and without any hassle are considered to have a sound liquidity position. Such entities are generally capable of handling financial downturns in a better way. The reverse is true for entities with weak liquidity position.

Analysts assess entities’ liquidity by using some basic ratios know as liquidity ratios. These ratios indicate whether or not a business owns adequate quantity of current resources to honor its current liabilities on maturity. Two frequently used liquidity ratios are briefly discussed below:

Current ratio:

Current ratio is the ratio of an entity’s total dollar value of current assets to total dollar value of current liabilities and is often expressed as coverage of so many times. For example, a company with total current assets of $75,000 and total current liabilities of $25,000 has a current ratio of 3 (= $75,000/$25,000) which means that the company can pay all of its current liabilities 3 times using current assets that it currently owns. Because the ratio measures the excess of an entity’s current assets over its current liabilities, some analysts name it as working capital ratio.

Although an extensively applied tool for liquidity analysis, current ratio has only a limited usefulness. It is just a quantitative measure which does not disclose anything about the quality of current assets owned by a business at a given time. For example, it does not reveal that a significant portion of total available current assets in the business may be tied up in slow-moving inventories. An important question about inventories like materials and goods-in-process is that how long the company will take to convert them into finished goods and what it will realize upon their sale to customers. Go to current ratio article for a detailed list of limitations.

Acid test ratio

Some analysts prefer to use acid test ratio over current ratio for liquidity analysis of entities. If inventories and prepaid expenses are eliminated from the total current assets, the remaining amount might provide a better insight into a company’s liquidity position. It is done by applying the acid test ratio which relates only cash, highly liquid short-term investments and receivables to total current liabilities. For example, the acid test ratio of a company with $25,000 cash, $15,000 marketable securities, $50,000 receivables and $60,000 current liabilities would be 1.5 [= ($25,000 + $15,000 + $50,000)/60,000]. It means if only these highly liquid assets are used, the company can pay its current liabilities 1.5 times.

Some other ratios that can be helpful and used in conjunction with these two ratios to test an entity’s liquidity are absolute liquid ratio, current cash debt coverage ratio, receivables turnover ratio and inventory turnover ratio.

i have learned a lot

thanks