Triple/three column cash book

The triple-column cash book (also referred to as the three-column cash book) is the most exhaustive form of cash book, which has three money columns on both receipt (Dr) and payment (Cr) sides to record transactions involving cash, bank, and discounts. A triple-column cash book is usually maintained by large firms that make and receive payments in cash as well as by bank and which frequently receive and allow cash discounts.

The procedure of recording transactions in a triple/three-column cash book is similar to that of a double-column cash book. The only difference between two types of cash books is that a double column cash book has two money columns (i.e., cash and bank), whereas a triple column cash book has three money columns (i.e., cash, bank, and discount).

The cash and bank columns of a triple-column cash book are used as accounts and are periodically totaled and balanced, just like in the case of a double-column cash book. The discount column is only totaled; it is not balanced because it does not work as an account.

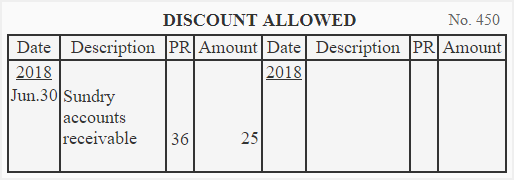

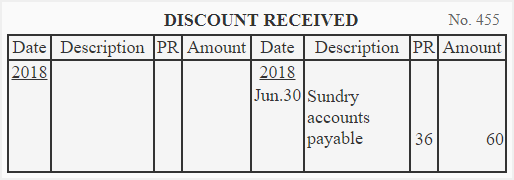

In the general ledger, two separate accounts are maintained for discount allowed and discount received. The total of discount column on the debit side of the cash book represents the total cash discount allowed to customers during the period and is posted to the discount allowed account maintained in the ledger. The total of the discount column on the credit side represents the total cash discount received from suppliers during the period and is posted to the discount received account maintained in the ledger.

Discount allowed is an expense, and discount received is an income of the business.

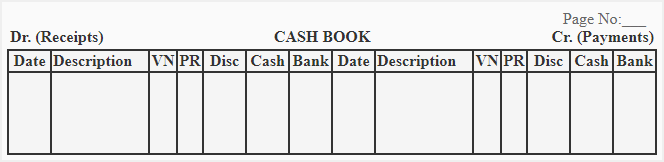

Format

The format of a triple/three column cash book is given below:

The triple-column cash book has 7 columns on both debit and credit sides. The purpose of each column is briefly explained below:

- Date: The date column is used to enter the transaction date.

- Description: The description column is used to write the name of the account to be debited or credited in the ledger as a result of a cash or bank transaction.

- Voucher number (VN): A voucher is a document in support of a transaction. The serial number of the voucher is entered in this column.

- Posting reference (PR): Each account in the ledger is assigned a unique number. The number of each ledger account that is written in the description column is entered in the PR column.

- Discount: The amount of discount allowed is recorded on the debit side, and the amount of discount received is recorded on the credit side in the discount column. The totals of debit column and credit column are posted to discount allowed account and discount received account, respectively.

- Cash: The amount of cash received (net of any discount allowed) is entered on the debit side, and the amount of cash paid (net of any discount received) is entered on the credit side in the cash column. This column is totaled and balanced like a ledger account.

- Bank: The amount of all receipts and payments made by the bank account are entered in the bank column of the cash book. This column is also totaled and balanced like a ledger account.

Posting a three column cash book to ledger accounts

As explained earlier in this article, only the cash and bank columns of the triple-column cash book work as accounts and are therefore balanced. The discount columns on both receipt and payment sides are only totaled and not balanced.

The procedure of posting entries from a cash book to ledger accounts has been explained in a single-column cash book article. The same procedure is followed for posting entries from double as well as triple column cash books to ledger accounts.

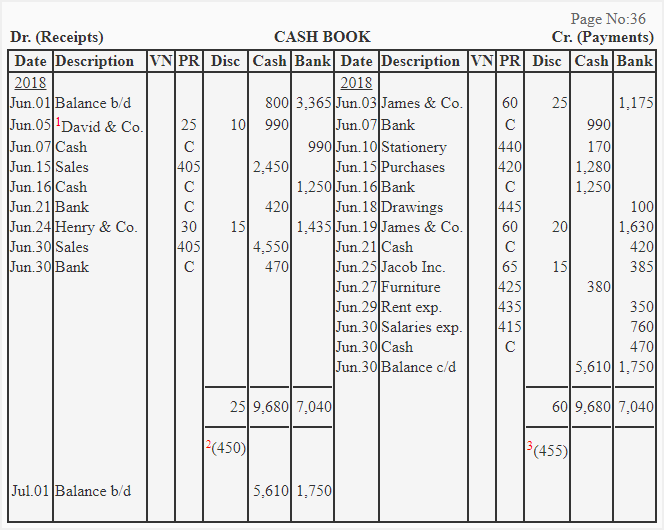

The following example summarizes the whole explanation of the triple-column cash book given above.

Example

P&G LLC records its cash and bank transactions in a triple-column cash book. The following transactions were performed by the company during the month of June 2018.

- Jun 01: Cash in hand $800 (debit balance), Cash at bank $3,365 (debit balance).

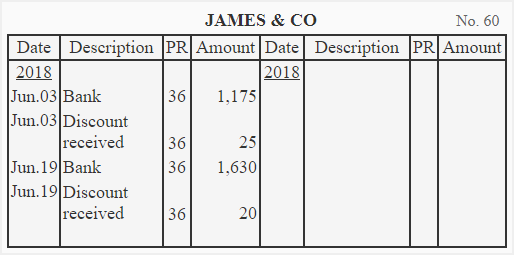

- Jun 03: Paid James & Co. by check $1,175, discount received from him $25.

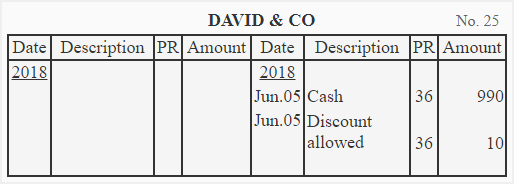

- Jun 05: Received from David & Co. a check amounting to $990, discount allowed to him $10.

- Jun 07: Deposited into bank the check received from David & Co.

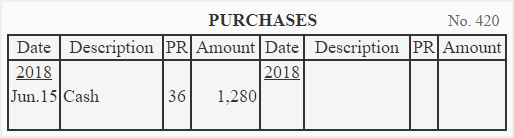

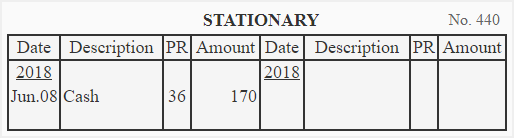

- Jun 10: Purchased stationary for cash, $170.

- Jun 15: Purchased merchandise for cash, $1,280.

- Jun 15: Cash sales for the first half of the month, $2,450.

- Jun 16: Deposited into bank $1,250.

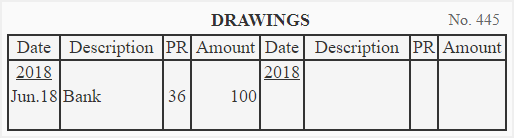

- Jun 18: Withdrawn from bank for personal expenses $100.

- Jun 19: Issued a check amounting to $1,630 to James & Co. and discount received from him $20.

- Jun 21: Drew from bank for office use, $420.

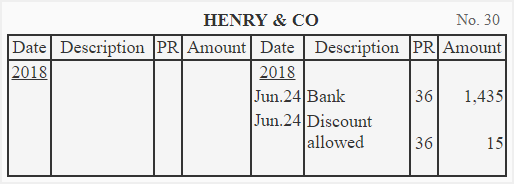

- Jun 24: Received a check amounting to $1,435 from Henry & Co. and allowed him a discount of $15. The Henry’s check was deposited into bank immediately.

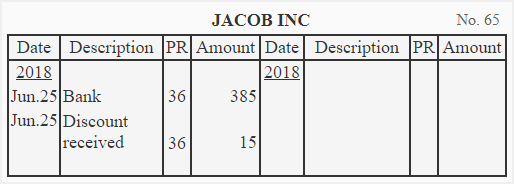

- Jun 25: Paid a check to Jacob Inc. amounting to $385 and received a discount of $15.

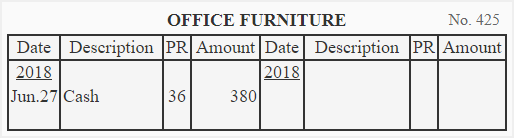

- Jun 27: Bought furniture for cash for office use, $380.

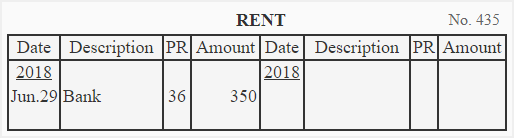

- Jun 29: Paid office rent by check, $350.

- Jun 30: Cash sales for the second half of the month $4,550.

- Jun 30: Paid salaries by check $760.

- Jun 30: Withdrew from bank for office use $470.

Required:

- Record the above transactions in a triple/three column cash book of P & G LLC and balance the cash and bank columns of the cash book.

- Post entries from the triple/three-column cash book to appropriate accounts in the general ledger, accounts receivable subsidiary ledger, and accounts payable subsidiary ledger.

Solution

1. Triple/three column cash book

1. Check received from David & Co. on June 05 has been recorded in the cash column because it was not deposited into bank on the same date.

2. 450 is the number of discount allowed account in the general ledger. The discount allowed account is an expense account.

3. 455 is the number of discount received account in the ledger. Discount received account is an income/revenue account.

1. Posting to ledger accounts:

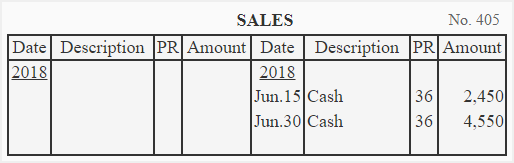

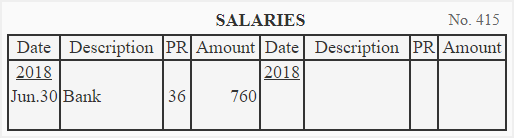

(i). General ledger:

(ii). Accounts receivable ledger:

(iii) Accounts payable ledger:

You the best on the way you are doing this

Hello, I was asking what is the entry of loan received on a 3 column cashbook.

The loan is an inflow of cash, either in your bank account or in your hand. It should be recorded in bank column if the loan amount is directly deposited into bank account by the lender of the loan. However, if the business receives the loan in cash, it should be recorded in the cash column. The entries in both the cases are as follows:

1. Bank Dr. and Loan Cr. (Entry would be made in bank column on receipts or debit side).

2. Cash Dr. and Loan Cr. (Entry would be made in cash column on receipts or debit side).

Balance brought forward is recorded on debit side or credit side

When someone buys goods on credit where is he recorded on debit side or credit side

Thanks

Is it at hand or at Bank?

If it’s at hand then it is the Cash column at debt side.

If at Bank then in the Bank column at debt side.

its debbited since in three column cashbook we only focus on money

If cash is withdrawn from bank for office use, will u treat it as a contra entry? Also this money ref 21 June on the posted quiz is an expenses, how can u transfer it to cash again??

It’s just a contra entry

Why on column of discount a not marching on DR and CR why

Or why we put DR25 and CR45

Read the whole tutorial carefully and you will find the answer to all of your questions

Contra entry is the transferring money from cash to bank or bank to cash

Well explained

Where is the credit recorded

I am very happy with your work my brother. I need you keep on the good work.

This is really very helpful, God bless you.

Is goods returned by a customer recorded in a three column cash book and how

I like the detailed explanation thank you

What if we have pre discounts how do we go about it

What if an outstanding was paid, where will it be recorded

Why is discount received (income/revenue) by the company recorded under the credit side and discount allowed (expenses) recorded under the debit side and not vice versa??

I understand it

But I’ll like it if u can send some three column cash book question to me to solve to know it better

That money will be used in the business.

Gilbert are you really an accountant?

Where do you put received commission by cheque in 3 column cashbook?

What if a debtor settles his account which side do you record

Am asking on three column cash book ss1 I need to do my assignment

If a check is received and deposited directly into the bank account, the amount should be debited in the bank column, but if not deposited, it should be treated as cash. Why cash?

I have a doubt what is the answer for he paid into current account 20000 in triple column cash book

Accounts receivable and payable whichbone do we credit and debit

Thank you for teaching me accounting entries on three column cash book