Treatment of non-manufacturing costs

Non-manufacturing expenses have no effect on the production cost of the company because they are treated as period costs.

Non-manufacturing costs are not included in manufacturing overhead account but are charged directly to income statement. Examples of non-manufacturing expenses are sales commission, advertising expenses, rent of office building, and depreciation on the equipment used in office etc.

Journal entries to record non-manufacturing costs:

To understand how entries for non-manufacturing costs are made, consider the following example:

GX company uses job order costing system and has incurred the following non-manufacturing expenses for the most recent period:

- Selling and administrative salary: $60,000

- Depreciation on office expenses furniture: $14,000

- Advertising expenses: $84,000

- Other selling and administrative expenses: $16,000

Required: make journal entries from the information provided above.

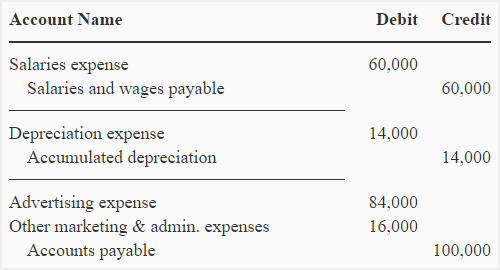

Journal entries:

Note: In entry 2, the depreciation on office furniture has been debited to depreciation expense because depreciation on office furniture or equipment is treated as period cost. If it were a depreciation on factory equipment, it would have been debited to manufacturing overhead because depreciation on factory equipment is treated as manufacturing or product cost.

Thanks for wonderful examples, it’s really helpful