Transaction analysis

Definition and explanation

Transaction analysis is a process of identifying the accounts involved in a transaction, determining the nature of those accounts, and finally analyzing the transaction’s financial impact on business. Sequentially, it is a part of the overall journalizing process, which is the next step of the accounting cycle. Each business transaction must be properly analyzed so that it can be correctly journalized and made part of the entity’s accounting record.

An incorrect analysis of business transactions leads to incorrect journal entries and therefore errors in accounting records. Consequently, it would not be possible to draft acceptable financial statements from such records.

Steps involved in transaction analysis

Transaction analysis is a four-step process, which is briefly elaborated below:

(1). Identifying the accounts involved:

Under the double-entry system of accounting, a transaction essentially involves at least two accounts. In the first step of transaction analysis, the names of these accounts are identified and extracted from the transaction. The account titles so obtained must be in line with the account titles listed in the organization’s chart of accounts (COA) and used in the general ledger. For example, Mr. Robert starts a trading business, namely Robert Traders, by investing $50,000 cash. This should be the first transaction of Robert Traders. The two accounts involved in this transaction are “Cash Account” and “Robert’s Capital Account”.

(2). Determining the nature of accounts involved:

In the second step, the nature of accounts identified in the first step is determined. For example, in the above transaction of Robert Traders, the cash account is an asset account by nature, and the capital account is an equity account by nature. In simple words, we can say that the cash account is classified as an asset account and Robert’s capital account is classified as an equity account.

Assets and equity are just two of the six classifications of accounts, the other four being liability, withdrawal, revenue, and expense. Read them all from our article classification of accounts.

(3). Analyzing the financial impact of transaction as a whole:

As stated earlier, every valid business transaction has a financial impact on the entity’s business. This simply refers to increase(s) or decrease(s) in accounts identified in the first step. For example, in the above transaction, the introduction of initial capital in the form of cash by Mr. Robert increases both cash account and capital account in the books of Robert Traders. The cash comes into the business, and at the same time, the owner’s capital or equity comes into existence.

(4). Application of rules of debit and credit:

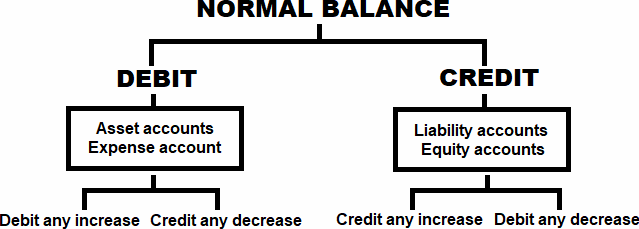

In the final step of transaction analysis, rules of debit and credit are applied to accounts classified in the second step. After correct application of these rules, the transaction is recorded in the general journal or a special journal in case the organization operates on a large scale. In the above transaction of Robert Traders, the cash account would be debited and Robert’s capital account would be credited. The reason for this entry is that the cash account is an asset account with a debit normal balance, whereas Robert’s capital account is an equity account with a credit normal balance. The accounting rules of debit and credit in this regard guide us as follows:

- If the normal balance of an account is debit, record any increase on the debit side of the account and any decrease on the credit side of the account.

- If the normal balance of an account is credit, record any increase on the credit side of the account and any decrease on the debit side of the account.

We have summarized the whole concept below:

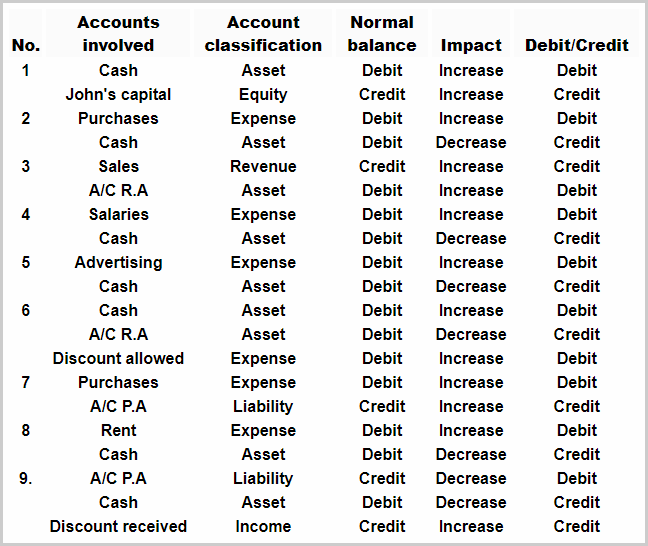

Let’s include some more transactions in Robert’s trading business. See the example below:

Example

The following transactions belong to Robert Traders:

- Commenced a trading business by investing $50,000 cash.

- Purchased inventory amounting to $30,000 for cash.

- Sold goods to Mr. Right amounting to $10,000 on credit.

- Paid salaries to employees amounting to $1,400

- Paid $150 to a local newspaper for running an advertising campaign.

- Received cash from Mr. Right of $9,750 and allowed him a cash discount of $250

- Purchased inventory amounting to $20,000 from Z & Co. on credit

- Paid $50 cash for warehouse rent.

- Paid to Z & Co. $19,700 and received a cash discount of $300.

Required: How would you analyze the above six transactions of Robert Traders?

Solution

Still confused? Let’s read more about normal balances of accounts and rules of debit and credit here.

cash at bank and capital and cash journal

Very helpful. Thanks much.

I need to know more about transaction analysis chart