Stable dollar value assumption

Introduction to the concept

An important purpose of preparing books of accounts and financial statements is to aid comparison of financial parameters across periods as well as across other organizations operating in the industry. To aid this, consistency in financial accounting is imperative. The stable dollar value assumption is an accounting principle that is modelled around this need for consistency.

This principle states that the value of the dollar used to denote financial transactions will remain the same and stable across accounting periods. Effectively, this means that accountants will ignore the concept of inflation while recording financial transactions in monetary terms. This means that no adjustment will be required in the financial statements to account for changes based on the changing value of the dollar or other base currency. Stable dollar value assumption is an integral principle of historical cost accounting.

Example to understand the concept

Michigan Manufacturing Company purchased a factory building in the year of its inception in 2012 for $100,000. Ten years later, in 2022, the company acquires an adjoining factory building on the same estate for its expansion plan. The new building is similar in size and design to the old one and will cost $150,000 in 2022.

Under the stable dollar value assumption, both buildings would be recorded at their book values, i.e., actual cost less any accumulated depreciation. Although we can assume that the value of the building purchased ten years ago for $100,000 is worth much more in 2022, probably around the same value as the new building, it would be recorded at its book value and not at the inflated value.

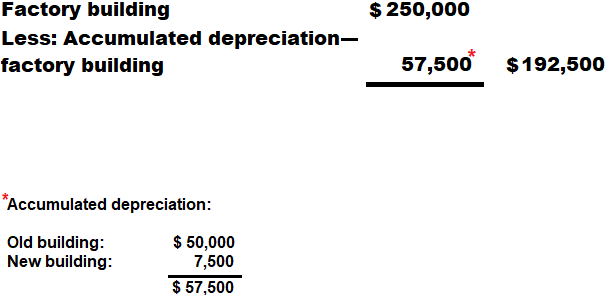

Suppose the accumulated depreciation on the old building is $50,000 (5% per year for 10 years) and on the new building is $7,500 (5% per year for 1 year) on December 31, 2022. The factory building would be reported under the fixed assets section of the balance sheet as follows:

Why is stable dollar value assumption important?

The stable dollar value assumption is an important part of historical accounting principles. Companies need to follow this assumption due to the following reasons:

1. Makes preparation simpler

This assumption assumes that the currency (dollar) does not change value over the years, and thus no regular adjustment for recording or reinstating items at their current market value is required. This makes it simpler to update accounting records and craft financial statements from those records.

2. Aids comparison

When financial statements are prepared on consistent and stable terms across periods, it becomes possible to compare them from year to year. This also aids in comparisons between different entities operating in the industry. For example, if entity A records its assets under a stable dollar value assumption, whereas entity B records them on a fair value basis, the comparison of the financial statements of the two entities will lead to erroneous conclusions.

3. Compliance with GAAP

Most jurisdictions follow the historical cost concept of accounting. Thus, in order to comply with globally recognized accounting principles, it is important for companies to follow the stable dollar value assumption.

Leave a comment