Single column cash book

The single-column cash book (also known as simple cash book) is a cash book that is used to record only cash transactions of a business. It is very identical to a traditional cash account in which all cash receipts are recorded on the left-hand (debit) side and all cash payments are recorded on the right-hand (credit) side in a chronological order.

The single-column cash book has only one money column on both debit and credit sides titled “amount,” which is periodically totaled and balanced like a T-account. As stated earlier, a single-column cash book records only cash related transactions. The entries relating to checks issued, checks received, purchase discount, and sales discount are not recorded in the single-column cash book.

Format:

The specimen/format of a single column cash book is given below:

The purpose of five columns used on both sides of a single-column cash book is briefly explained below:

- Date: The date column of the cash book is used to record the year, month, and actual date of each cash transaction. This column ensures the chronological record of each business transaction involving receipt or payment of cash.

- Description: The description column is used to record the account titles to be debited or credited as a result of each cash transaction. A short explanation (also known as narration) of each cash transaction may also be written in this column. This column is sometimes titled “particulars.”

- Voucher No: A voucher is a document that supports a business transaction. This column is used to record the serial number of a receipt voucher or payment voucher.

- Posting reference: This column is used to write the page number of each ledger account named in the description column of the cash book.

- Amount: The amount column of a single-column cash book is used to record the money value of each cash transaction.

Balancing a single column cash book

The single-column cash book has only one money column, which is totaled and balanced like a traditional T-account. At the end of each month or another appropriate period, the amount column of both sides is totaled. The difference between totals is written on the lighter side below all other entries. This difference is the closing cash balance for the current period and is usually termed the balance carried down (balance c/d). In the next period, it becomes the opening cash balance and is usually termed the balance brought down (balance b/d).

Note: The debit side (receipt side) of a single-column cash book is always heavier than the credit side (payment side) because we cannot pay more cash than we receive during a period.

Posting entries from single column cash book to ledger accounts

All entries in the cash book are periodically posted to appropriate accounts in the general ledger and relevant subsidiary ledgers. The posting procedure is given below:

- The balance b/d and balance c/d (i.e., opening and closing balances) of the cash book are not posted.

- The entries on the debit side (or receipt side) of the cash book are posted to the credit side of relevant accounts in the ledger.

- The entries on the credit side (or payment side) of the cash book are posted to the debit side of relevant accounts in the ledger.

- The page numbers of the ledger accounts (i.e., account numbers) to which the entries have been posted are written in the posting reference column of the single-column cash book. It makes it easy to locate an account in the ledger to which an entry has been posted.

Example

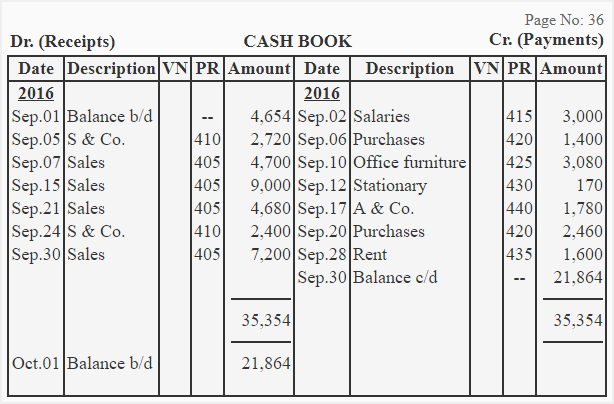

Harper Company uses a single-column cash book to record all cash transactions. It engaged in the following cash transactions during the month of September 2016.

- Sep.01: Cash in hand at start of the month $4,654.

- Sep.02: Paid salaries to employees for the last month $3,000.

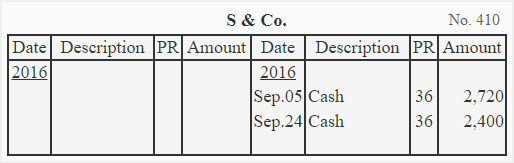

- Sep.05: Cash received from S & Co. for a previous credit sale $2,720.

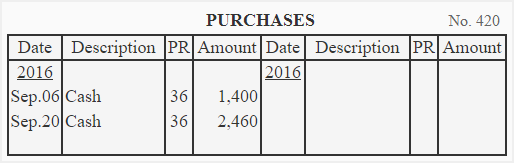

- Sep.06: Merchandise purchased for cash $1,400.

- Sep.07: Merchandise sold for cash $4,700.

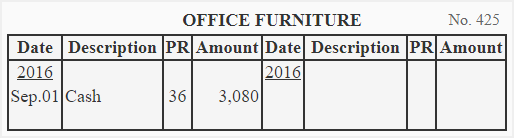

- Sep.10: Office furniture purchased for cash $3,080.

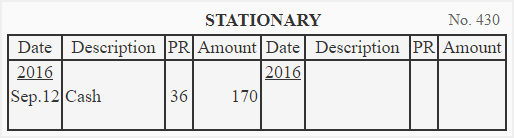

- Sep.12: Stationary purchased for cash $170.

- Sep.15: Merchandise sold for cash $9,000.

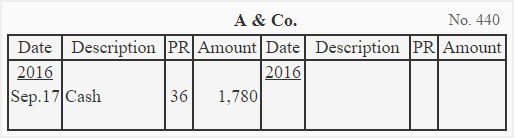

- Sep.17: Cash paid to A & Co. for a previous credit purchase $1,780.

- Sep.20: Merchandise purchased for cash $2,460.

- Sep.21: Merchandise sold for cash $4,680.

- Sep.24: Cash received from S & Co. for a previous credit sale $2,400.

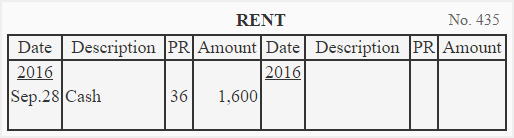

- Sep.28: Cash paid for office rent $1,600.

- Sep.30: Merchandise sold for cash $7,200

Required: Record the above transactions in a single-column cash book (simple cash book) and post entries from the cash book to the relevant ledger accounts in general and subsidiary ledgers.

Solution

Single column cash book of Harper Company:

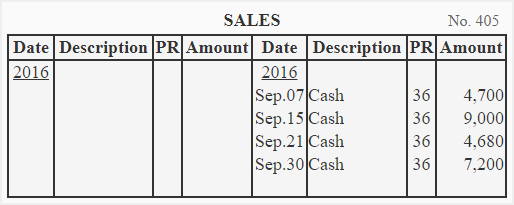

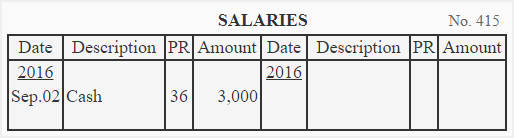

General ledger of Harper Company:

Accounts receivable subsidiary ledger of Harper Company

Accounts payable subsidiary ledger of Harper Company

Very useful

Very useful

Owesome, very useful and also safes time

Simple and brief,,,i understood it in a few minutes

You are very correct

It is so self explanatory

I just love it❤️

Is credit payment received same as receiveoney from debtors

The best have ever met…Well briefed but contented .

Really nice

Excellent

Good lectures

Nice presentation