Sales volume variance

Definition and explanation

Sales volume variance (also known as sales quantity variance) occurs when actual quantity of units sold deviates from the standard or budgeted quantity of units sold during a specific period of time.

It may be defined as the difference between the actual units sold at standard price and standard units sold at standard price.

If the actual quantity of units sold is more than the budgeted quantity of units sold, the sales volume variance would be favorable and if on the other hand, the actual quantity of units sold is less than the budgeted quantity of units sold, the variance would be unfavorable.

A favorable sales volume variance indicates higher actual revenue than the standard revenue which usually translates into higher profit. An unfavorable variance, on the other hand, means lower actual revenue than the standard revenue which usually translates into lower profit for the business.

Formula

The formula for calculating sales volume variance is give below:

(Actual number of units sold × Budgeted price per unit) – (budgeted number of units sold × Budgeted price per unit)

or

(Actual number of units sold – budgeted number of units sold) × Budgeted price per unit

Example 1

The sales department of Robert Mineral Water Private Limited estimates that for the third quarter of the current financial year, the company would sale 5,000,000 bottles of mineral water at an estimated price of $1.15 per bottle. These budgets are based upon the sales volumes of previous quarters and an expected growth in the next quarter. When the real results of the sales of third quarter unveil, company records an unfavorable sales volume variance as real sales of third quarter are 4,835,000 bottles. Upon further investigation, it was revealed that one of the costumers of Robert Mineral Water Pvt. Ltd. Became bankrupt due to which sales were ceased to that costumer.

The sales volume variance for the third quarter would be:

Sales volume variance = (4,835,000 bottles – 5,000,000 bottles) × $1.15

= $189,750 unfavorable

Example 2

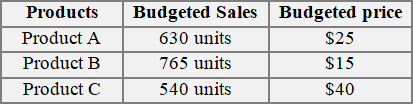

The Martin Trader sells three products – product A, product B and product C. The budgeted sales and budgeted prices of all three products for the first quarter of the current year are given below:

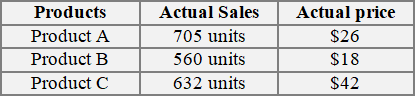

The actual results for the first quarter in terms of quantity sold and price are given below:

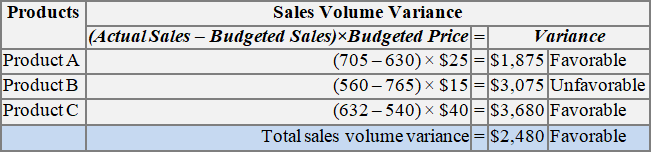

Required: Using the information of Martin Traders given above, calculate sales volume variance for the individual products as well as in total for the first quarter.

Solution

Use of standard profit per unit and standard contribution per unit instead of standard sales price per unit

In above examples, we have used budgeted sales price per unit to calculate sales volume variance. Instead of budgeted sales price, budgeted profit per unit or budgeted contribution per unit can also be used to calculate this variance. In these cases, the formula would be written as follows:

1. If budgeted or standard profit per unit is used

If budgeted or standard profit per unit is used to calculate the sales volume variance, the difference between actual units sold and the budged units sold is multiplied by the budgeted or standard profit per unit.

(Actual number of units sold – budgeted number of units sold) × Budgeted or standard profit per unit

This formula is applied in situations where absorption costing approach is used.

2. If budgeted or standard contribution per unit is used

If budgeted or standard contribution per unit is used to calculate the sales volume variance, the difference between actual units sold and the budged units sold is multiplied by the budgeted or standard contribution per unit.

(Actual number of units sold – budgeted number of units sold) × Budgeted or standard contribution per unit

This formula is applied in situations where variable costing approach is used.

Causes of sales volume variance

The possible causes of favorable sales volume variance include reduction in competition, decrease in price of the product, elimination of trade restrictions previously imposed by the government, improper or inaccurate budgeting etc.

The possible causes of unfavorable sales volume variance include increase in competition, increase in sales price, decrease in demand of product in question because of the launch of another product by the company, product obsolescence because of change in taste and fashion, trade restrictions imposed by the government, serious issues with the product that could cause a negative impact on customers’ trust and improper or inaccurate budgeting etc.

Thank you very much!