Sales journal

Content:

- Definition and explanation

- Sales invoice

- Format of sales journal

- Posting from sales journal to subsidiary and general ledger

- Example

- Sales journal with sales tax column

Definition and explanation

The sales journal (also known as the sales book or sales day book) is a special journal used to record all credit sales. Every transaction that is entered in this journal essentially results in a debit to the accounts receivable account and a credit to the sales account. Cash sales are not recorded in the sales journal; rather, they are recorded in another special journal known as the cash receipts journal.

In the context of this article, the term sale refers to the sale of only those goods or merchandise that the organization normally deals in. Any sale of used or outdated assets (like old plants, machinery, equipment, newspapers, etc.) is not recorded in the sales journal. These transactions are entered in the general journal, also known as the journal proper.

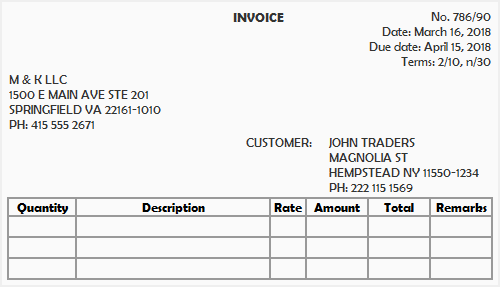

Sales invoice

When a seller sells merchandise on credit, he prepares an invoice known as the sales invoice or outward invoice. This invoice is sent to the customer, usually along with the merchandise sold. The seller also prepares a duplicate copy of each invoice he sends out to his buyer. This duplicate copy is kept by the seller with him because the entry in the sales journal is made on the basis of it.

Format of sales invoice

The specimen/format of a simple sales invoice or outward invoice with some basic information is given below:

If you have already read the “purchases journal” article, you may have noticed that the sales invoice and purchase invoice are two different names given to the same document. It is always prepared by the seller and is called the sales invoice in the record of the seller and the purchase invoice in the record of the buyer. The seller uses it to record a sales transaction in his sales journal, and the buyer uses it to record a purchase transaction in his purchases journal.

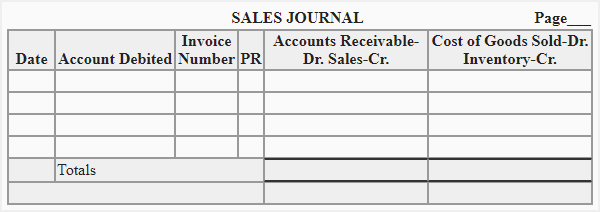

Format of sales journal

The information recorded in a sales journal depends on the nature and needs of each individual business. However, a commonly used format of sales journal is given below:

Explanation of columns

A brief explanation of the columns used in the above format of the sales journal is as follows:

- Date: This column is used to record the date on which the sale is made. Normally, it is the same date as written on the sales invoice.

- Account debited: This column is used to enter the name of customers whose individual accounts are maintained in the accounts receivable subsidiary ledger.

- Invoice number: The sales invoice number is written in this column.

- Post reference (PR): The entries in the sales journal are posted to relevant accounts in the receivables subsidiary ledger on a daily basis. The post reference is used to enter the account numbers of individual accounts in the subsidiary ledger to which the entries are posted.

- Accounts receivable & Sales: In this column, the net amount receivable from customers is written. In the general ledger, the accounts receivable account is debited and the sales account is credited by the total of this column.

- Cost of goods sold & inventory: In this column, the cost price of the merchandise sold is entered. In the general ledger, the cost of goods sold account is debited, and the inventory account is credited by the total of this column.

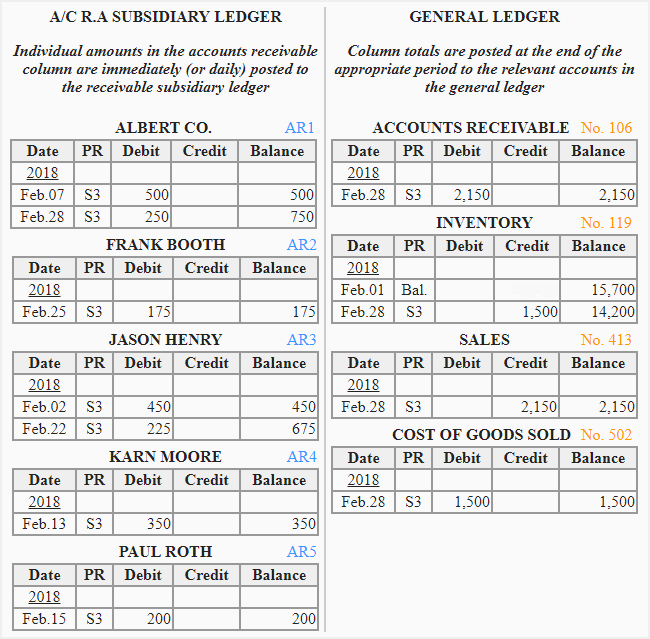

Posting entries from sales journal to subsidiary and general ledger

The entries in the sales journal must be posted to the subsidiary and general ledger. This posting procedure is briefly explained below:

(1). Posting to accounts receivable subsidiary ledger:

At the end of each day (or immediately after the transaction has been performed), the individual entries are debited to appropriate accounts in the accounts receivable subsidiary ledger.

(2). Posting to general ledger:

At the end of each month or another appropriate period, totals of the columns of the sales journal are posted to the relevant general ledger accounts as follows:

- The total of accounts receivable & sales columns is debited to the accounts receivable account and credited to the sales account in the general ledger.

- The total of the cost of goods sold & inventory column is debited to the cost of goods sold account and credited to the inventory account in the general ledger.

To indicate that the posting from the sales journal to the general ledger has been made, the numbers of the general ledger accounts are mentioned in parentheses below the totals of the relevant columns of the sales journal.

Consider the following example for a better explanation of the whole procedure.

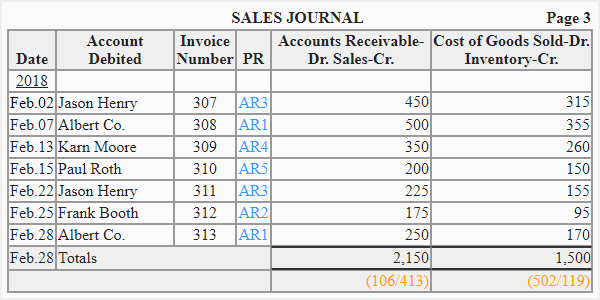

Example

The following example illustrates how transactions are recorded in a sales journal and how entries from there are posted to subsidiary and general ledgers.

Recording entries in sales journal

Posting entries from sales journal to ledger accounts

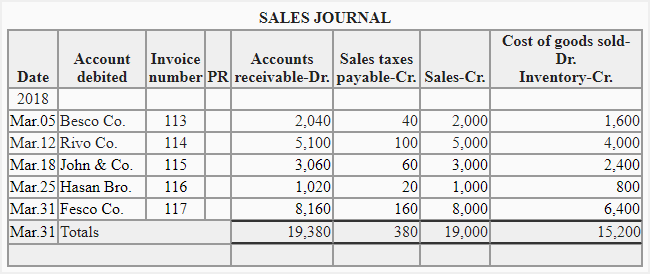

Sales journal with a “sales tax payable” column

The sellers are generally instructed by the government to collect sales tax from their customers on the sale of certain goods and services and send the same to the appropriate tax agency. If a business is collecting sales tax from customers, it is convenient to add a sales tax payable column to its sales journal. An example of the sales journal with a sales tax payable column is given below:

The sales journal given above shows that the seller is collecting sales tax at 2% on all goods sold to customers. The posting of this sales journal will be similar to that explained in the above example.

A sales tax payable account is opened in the general ledger, and the total of the sales tax payable column is credited to that account at the end of each month or another appropriate period.

To know how to post transaction to sales journal

How to post

Cash payment journal

How do you calculate cost of goods sold or inventory in the sales journal?

The total of the last column.

How to post