Rules of debit and credit

Contents:

- Definition and explanation

- Normal balance of accounts

- Application of rules of debit and credit

- Example

Definition and explanation

The rules of debit and credit (also referred to as golden rules of accounting) are the fundamental principles of modern double entry accounting. They guide accountants and bookkeepers in journalizing financial transactions and updating ledger accounts of their business entity. Since the accounting cycle starts with a journal comprising of debit and credit entries, the use of a double entry accounting is not possible without strict adherence to these rules. The rules of debit and credit are the heart of accounting and their understanding is extremely important for individuals responsible for handling the accounting system of a business entity.

In article business transaction, we have explained that an event can be journalized as a valid financial transaction only when it explicitly changes the financial position of an entity. In accounting, a change in financial position essentially signifies an increase or decrease in the balances of two or more accounts or financial statement items. The rules of debit and credit determine how a change affected by a financial transaction can be updated in a journal and then applied to accounts in ledger.

Let’s see in detail what these fundamental rules are and how they work when a business entity maintains and updates its accounting records under a double entry system of accounting.

A ledger account (also known as T-account) consists of two sides – a left hand side and a right hand side. The left hand side is commonly referred to as debit side and the right hand side is commonly referred to as credit side. In practice, the term debit is denoted by “Dr” and the term credit is denoted by “Cr”. In the rest of this discussion, we shall use the terms debit and credit rather than left and right.

When a financial transaction occurs, it affects at least two accounts. For example, purchase of machinery for cash is a financial transaction that increases machinery and decreases cash because machinery comes in and cash goes out of the business. The increase in machinery and decrease in cash must be recorded in the machinery account and the cash account respectively. As stated earlier, every ledger account has a debit side and a credit side. Now the question is that on which side the increase or decrease in an account is to be recorded. The answer lies in the learning of normal balances of accounts and the rules of debit and credit.

Let’s first look at the normal balances of accounts and then learn how the rules of debit and credit are applied to record transactions in journal.

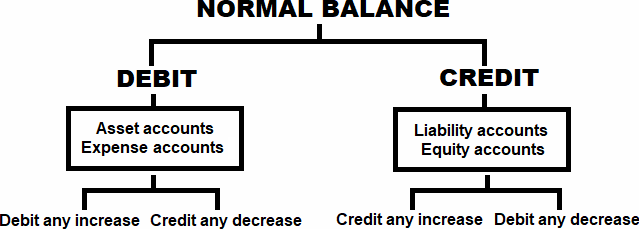

Normal balances of accounts

The understanding of normal balances of accounts helps understand the rules of debit and credit easily. If the normal balance of an account is debit, we shall record any increase in that account on the debit side and any decrease on the credit side. If, on the other hand, the normal balance of an account is credit, we shall record any increase in that account on the credit side and any decrease on the debit side.

The normal balance of all asset and expense accounts is debit where as the normal balance of all liabilities, and equity (or capital) accounts is credit. The normal balance of a contra account (discussed later in this article) is always opposite to the main account to which the particular contra account relates.

Application of the rules of debit and credit

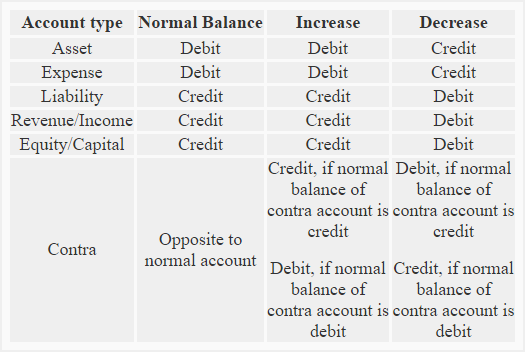

The basic rules of debit and credit applicable to various classifications of accounts are listed below:

(1). Asset accounts:

Normal balance: Debit

Rule: An increase is recorded on the debit side and a decrease is recorded on the credit side of all asset accounts.

(2). Expense accounts:

Normal balance: Debit

Rule: An increase is recorded on the debit side and a decrease is recorded on the credit side of all expense accounts.

(3). Liability accounts:

Normal balance: Credit

Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all liability accounts.

(4). Revenue/Income accounts:

Normal balance: Credit

Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all revenue accounts.

(5). Capital/Equity accounts:

Normal balance: Credit

Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all equity accounts.

(6) Contra accounts:

Normal balance: Always opposite to the relevant normal account. The normal balance of a contra account can be a debit balance or a credit balance

Examples of contra account: Accounts receivable is an asset account that normally has a debit balance. The allowance for doubtful accounts is a contra account to the accounts receivable and normally has a credit (opposite) balance.

Other examples of contra accounts include:

- accumulated depreciation account – a contra asset account

- sales returns and allowances account – a contra revenue account

- sales discount account – a contra revenue account

- drawings account – a contra equity account

- treasury stock account – a contra equity account

- bonds discount account – a contra liability account

Since the normal balance of a contra account is always opposite to the normal balance of the relevant main account, it causes a reduction in the reporting amount of the main account. For example, if the balance in building account is $500,000 and the balance in accumulated depreciation – building account is $150,000, the building would be reported at $350,000 (= $500,000 – $150,000) in the balance sheet. Similarly, if the balance in allowance for doubtful accounts is $5,000 and the balance in accounts receivable account is $175,000, the accounts receivable would be reported at $170,000 which is their net realizable value.

Rule: If the normal balance of the contra account is debit, any increase will be recorded on the debit side and any decrease will be recorded on the credit side. If, on the other hand, the normal balance of the contra account is credit, the increase is recorded on the credit side and the decrease is recorded on the debit side.

A summary of the whole discussion about rules of debit and credit is given below:

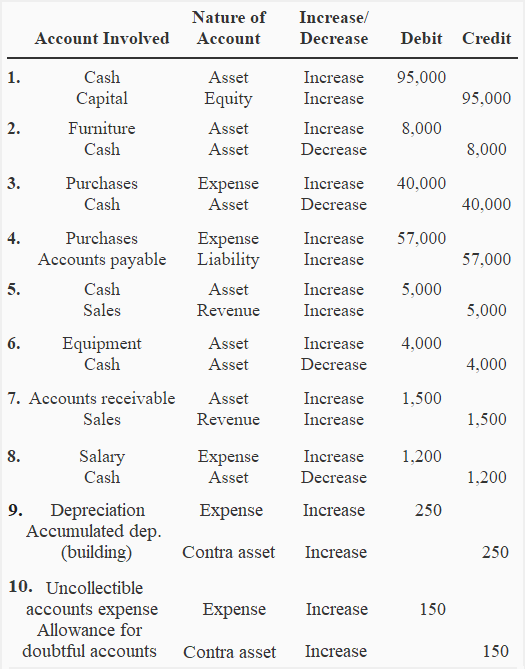

The following example may be helpful to understand the practical application of rules of debit and credit explained in above discussion.

Example of debit and credit rules:

The following transactions are related to Small Traders:

- Started business with cash $95,000.

- Furniture purchased for cash to be used in business $8,000.

- Purchased goods for cash $40,000.

- Purchased goods on credit from Big Traders $57,000.

- Sold goods for cash $5,000.

- Purchased equipment for business $4,000.

- Sold goods on credit to John Retailers $1,500.

- Paid salary to employees $1,200

- Recorded annual depreciation on building $250

- Recorded uncollectible accounts expense at the end of the year $150

Required: Identify the accounts involved in above transactions and state the nature of each account. Also mention how increases or decreases in accounts resulting from above transactions should be recorded in accordance with the rules of debit and credit described in this article.

Solution:

great

This is great!! Thank you all for providing this information and breaking it down in the way that you did!

Thank you for the information that you’re providing it. Now I get to understand the concept of Dr and Cr. “THANK YOU”

Thank you for your information about Dr and Cr, but I’ll keep in touch with you guys to know more about accounting information

Thanks allot for the information

I really understood this concept

Thanks a lot! Helpful for exam!😉