Rent payable

Definition and explanation

Rent payable (or accrued rent) is simply the unpaid rent expense of a business entity at the end of its accounting period. Entities need properties like lands and buildings to set up their offices, factories, branches and warehouses etc. and when they don’t own, buy or construct these properties on feasible locations, they have to obtain them on rent from an owner. Rent payable liability arises when a business has held, occupied or benefited from a rented property for an accounting period and the rental payment for the same is still due at the end of the period. A liability account named as “rent payable account” is maintained in the general ledger to account for any unpaid rental payments.

Journal entry to record rent payable liability

Under accrual concept, an entity must recognize a rent expense in each period in which it has occupied the rented property. In this regard, if the tenant entity has not already paid the rental amount to the property owner, it must accrue the rent expense by means of debiting Rent Expense Account and crediting Rent Payable Account. The adjusting entry for this would look like the following:

Rent expense [Debit]

Rent payable [Credit]

The above entry recognizes rent expense for the period for which the property has been held and at the same time it creates a liability for the unpaid rent. Rent payable liability is classified as short term or current liability in the balance sheet because it is highly expected to be met within one year period of the date of its creation.

The entry to extinguish rent payable liability at the time of payment to landlord or property owner is given below:

Rent payable [Debit]

Cash [Credit]

Under accrual system, the entry to recognize rent expense is passed on the basis of hold or usage of the property by the tenant entity. This treatment differs from cash basis of accounting under which no accrual entry is recorded and the rent expense is recognized only when the rental cash is paid to the land lord or the property owner.

Example

On December 1, 2020, the Hannifin corporation obtains a building on rent to setup a factory in it. The rent agreement calls on Hannifin to make a rental payment of $2,500 on the first day of each month following the month in which the tenant holds the building, the first month’s rent being payable on January 1, 2021. Hannifin follows a strict accrual system to maintain its accounts. Its accounting period ends on December 31 and it passes adjusting entries on the last day of each month.

Required: In the books of Hannifin:

- make an adjusting entry to accrue the rent expense on December 31, 2020.

- show the rent payable liability in Hannifin’s balance sheet as on December 31, 2020.

- make an entry for the first rental payment on January 1, 2021.

Solution:

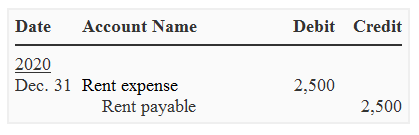

1. Adjusting entry to accrue rent expense:

Hannifin has occupied the building for December; hence, it must realize rent expense for December in its books by making the following accrual entry on December 31, 2020.

2. Balance sheet presentation of rent payable as current liability

On December 31, 2020, Hannifin must report in its balance sheet the rent payable of $2,500 as current liability.

3. Entry to make the first rental payment:

As per agreement terms, Hannifin is required to pay to the property owner the rent for December on January 1, 2021; hence, It must make the following entry immediately after payment on that date:

The above journal entry would settle the rent payable liability of $2,500 created through the adjusting entry on December 31, 2020 and remove the same from Hannifin’s books.

Would this apply using OCBOA (Other Comprehensive Basis of Accounting)?