Recognition of revenue from marketable securities

Investment in marketable securities generate dividend or interest revenue that must be entered in the accounting records of the company that owns the investment.

Journal entry to record the revenue from marketable securities

The cash account is debited and dividend revenue account or interest revenue account is credited to record the revenue generated by marketable securities.

(1). Marketable equity securities:

If the marketable securities are equity securities, they generate dividend revenue for the investor that is recorded by making the following journal entry:

(2). Marketable debt securities:

If the marketable securities are debt securities, they generate interest revenue for the investor that is recorded by making the following journal entry:

Example

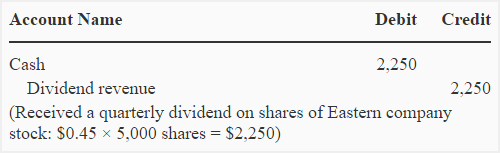

Fine Company has a short term investment of 5,000 shares in Eastern Company. It receives a dividend of $0.45 per share on this investment.

Required: Prepare a journal entry to record the above information.

Solution:

The dividend or interest revenue generated by marketable securities is included in the computation of total income before taxes. It usually appears near the bottom of the income statement.

Classification of cash flows from dividend/interest revenues

The cash received as dividend/interest revenue is classified as operating cash flow under US generally accepted accounting principles (GAAP) and is included in the operating activities section of the statement of cash flows, but if international financial reporting standards (IFRS) are applicable, it can be reported as operating, investing or financing cash flow depending on the accounting policy of the entity.

Thank you so much for your explanation and contribution. Much appreciated.