Prudence concept of accounting

Definition and explanation

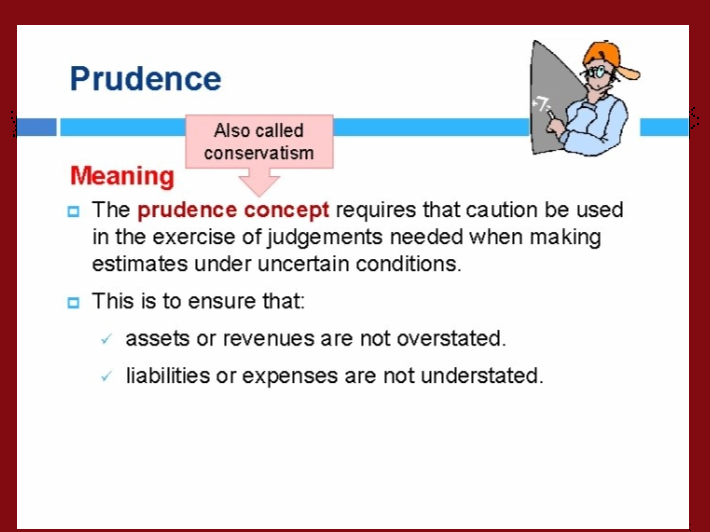

The prudence concept of accounting states that an entity must not overestimate its revenues, assets, and profits and must not underestimate its liabilities, losses, and expenses.

The prudence concept is a very fundamental concept of accounting that increases the trustworthiness of the figures reported in the financial statements of a business. The concept advises that the final accounts of a company must always show caution while reporting any figures, specifically those impacting income and expenses. It means that the preparer must always show a conservative approach while reporting profits, revenues, and assets and must only record them when they are actually realized or realizable. Simultaneously, a company must always adopt a proactive approach towards the recognition of liabilities, losses, and expenses.

Another name used for prudence concept is the conservatism principle of accounting.

In simple terms, the entity must not overvalue its profits and assets until irrefutable evidence is obtained. At the same time, it must not undervalue its losses and expenses and must record provisions even if the possibility of their occurrence exists.

At first glance, it seems that the prudence concept requires business entities to record every less favorable situation, but it actually does not. The concept basically urges that financial statements must present a realistic perspective about every possible event that may impact the decision of the users of financial statements. International Financial Reporting Standards (IFRS’s) and Generally Accepted Accounting Principles (GAAPs) are two broadly used accounting frameworks. Both incorporate the concept of prudence into many standards that fall within their scope.

Importance/advantages of prudence concept

The key advantages of working with prudence concept are listed below:

- The prudence concept helps minimize the chances of underestimating or overestimating the financial risk present in a particular investment or company.

- It helps present a fair and realistic view of financial statement items like revenues, assets, losses, expenses, and liabilities.

- It makes the financial statements of an entity comparable with those of others operating within the industry.

- It urges caution in recording assets, liabilities, revenues, and expenses and thus helps minimize losses.

Examples of prudence concept

Let’s take some examples to further elaborate on the concept of prudence.

1. Recording of provision for bad debts

In the balance sheet, the “provision for bad and doubtful debts” is reported in the receivables section of current assets and is deducted from the final amount of debtors or receivables. This provision does not show the debtors that have actually become bad. Rather, it shows the debtors that may end up bad based on their trading history with the company or their specific circumstances. Ultimately, the company may not recover money from them. These doubtful debtors are included in the provision under the prudence concept of accounting.

2. Recording of inventory

In IAS2 (International Accounting Standard for Inventory), the inventory is always valued at the lower of the original cost or net realizable value (i.e., selling price less cost to sell), so that inventory may not be overvalued. The valuation of inventory directly impacts the cost of sales because the cost of sales is equal to opening stock plus purchases minus closing stock.

3. Recording of liabilities and expenses

There are many liabilities that are not certain either in terms of amount or in terms of date, but they have a high possibility of occurrence. In such cases, the liability is recorded, and a corresponding expense is also recognized. This practice makes sure that both liabilities and expenses are not understated.

Thank you