Proprietary ratio

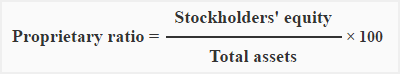

The proprietary ratio (also known as net worth ratio or equity ratio) is used to evaluate the soundness of the capital structure of a company. It is computed by dividing the stockholders’ equity by total assets.

Formula:

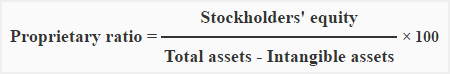

Some analysts prefer to exclude intangible assets (goodwill etc.) from the denominator of the above formula. In that case, the formula would be written as follows:

The information about stockholders’ equity and assets is available from balance sheet.

Example:

Al-Faisal Inc. has the following in its balance sheet as on December 31, 2021:

- Total assets: $950,000

- Intangible assets: $150,000

- Stockholder’s equity: $440,000

From the above information we can compute the proprietary ratio of Al-Faisal as follows:

(440,000 / 800,000 ) × 100

= 55%

The proprietary ratio is 55%. It means stockholders’ has contributed 55% of the total tangible assets. The remaining 45% have been contributed by creditors.

Significance and interpretation:

The proprietary ratio shows the contribution of stockholders’ in total capital of the company. A high proprietary ratio, therefore, indicates a strong financial position of the company and greater security for creditors. A low ratio indicates that the company is already heavily depending on debts for its operations. A large portion of debts in the total capital may reduce creditors interest, increase interest expenses and also the risk of bankruptcy.

Having a very high proprietary ratio does not always mean that the company has an ideal capital structure. A company with a very high proprietary ratio may not be taking full advantage of debt financing for its operations that is also not a good sign for the stockholders.

Leave a comment