Process costing – abnormal loss or spoilage

This page explains abnormal loss and its treatment in a process costing system. If you want to learn about the treatment of normal loss, navigate to the previous page.

In process costing, abnormal loss can be defined as the loss or spoilage of units in a processing department that should not occur under normal and efficient working conditions. The abnormal loss signifies that the production operation has one or more serious issues that need to be identified and fixed quickly. Major factors that may contribute to the occurrence of abnormal losses in a production process include the use of faulty equipment, unskilled or untrained workers, the use of substandard raw materials, improper supervision, frequent electricity breakdowns, working conditions with a lot of room for improvement, etc.

Difference between normal and abnormal loss

The core factor in differentiating between a normal and abnormal loss is the degree of controllability. The degree of controllability in the case of a normal loss is much smaller than in the case of an abnormal loss.

The normal loss is referred to as an uncontrollable loss because it is inherently attached to certain production processes and can’t be avoided even under the most efficient working conditions. Examples of such losses include weight loss, evaporation, and shrinkage of materials. We can’t do too much to stop these losses from occurring, as the degree of controllability is usually very small to zero in the case of normal losses.

The abnormal loss, on the other hand, is referred to as a controllable loss because it can be avoided under normal and efficient working conditions. It is essentially an unnecessary loss because it occurs due to carelessness, the use of low quality materials, the use of inefficient or faulty machines in the manufacturing process, and other similar factors that are controllable in nature.

Treatment of abnormal loss in process costing

There are two methods for the treatment of abnormal loss in a process costing system. It is either charged to factory overhead or an expense account for the current period and is presented as a separate line item on the cost of goods sold statement. Under the first treatment, abnormal loss causes an additional unfavorable factory overhead variance.

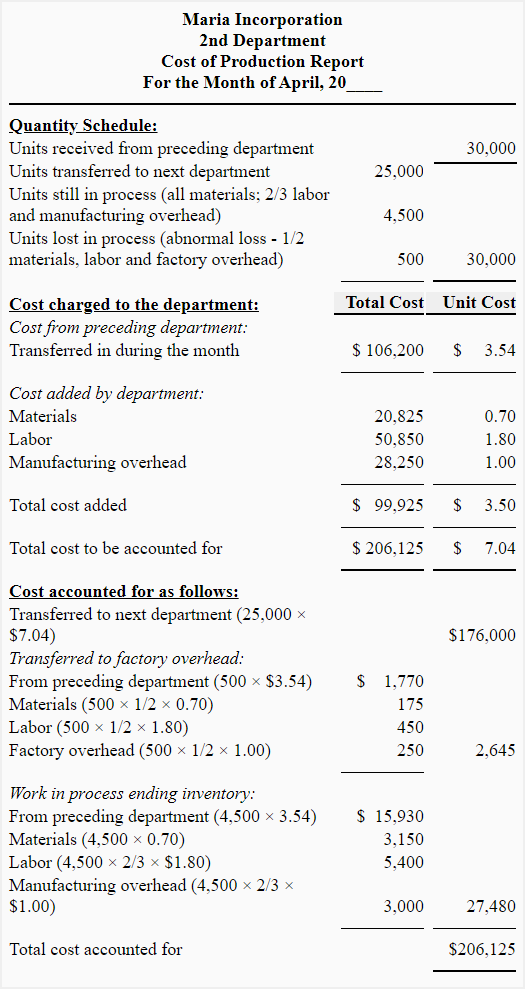

Let’s take an example to illustrate the treatment and presentation of the abnormal loss on a cost of production report.

Example

Maria Inc. has two processing departments and uses a process costing system. During April, the 2nd department received 30,000 units from the 1st department at a total cost of $106,200. Costs added in the 2nd department were:

- Materials: $20,825

- Labor: $50,850

- Factory overhead: $28,250

Out of 30,000 units received from the 1st department, 25,000 units were fully processed and transferred to the 3rd department, 4,500 units were still in process at the end of April (all materials, 2/3 labor and factory overhead) and 500 units were lost in process (1/2 complete as to materials, labor and factory overhead). There was no work-in-process beginning inventory.

The entire loss occurred in the 2nd department was abnormal. Maria charges all abnormal losses to factory overhead.

Required: Using the above information, prepare a cost of production report (CPR) for April for the 2nd department of Maria Inc.

Solution

Equivalent units and unit cost

Equivalent units:

Materials: [25,000 + 4,500 + (500 × 1/2)] = 29,750 units

Labor and factory overhead: [25,000 + (4,500 × 2/3) + (500 × 1/2)] = 28,250 units

Unit cost:

Materials: $20,825/29,750 units = $0.70/unit

Labor: $50,850/28,250 units = $1.80/unit

Factory overhead: $28,250/28,250 units = $1.00/unit

Notice that not only the number of units transferred to the next department and the stage of completion of units in work-in-process ending inventory but also the stage of completion of abnormally lost units have been taken into account while computing the equivalent units of production.

Thanks. Notes are very understandable