Exercise 18: Cost of production report – normal and abnormal loss

Learning objective:

This exercise illustrates the treatment of both normal and abnormal losses when they occur at the end of the production process.

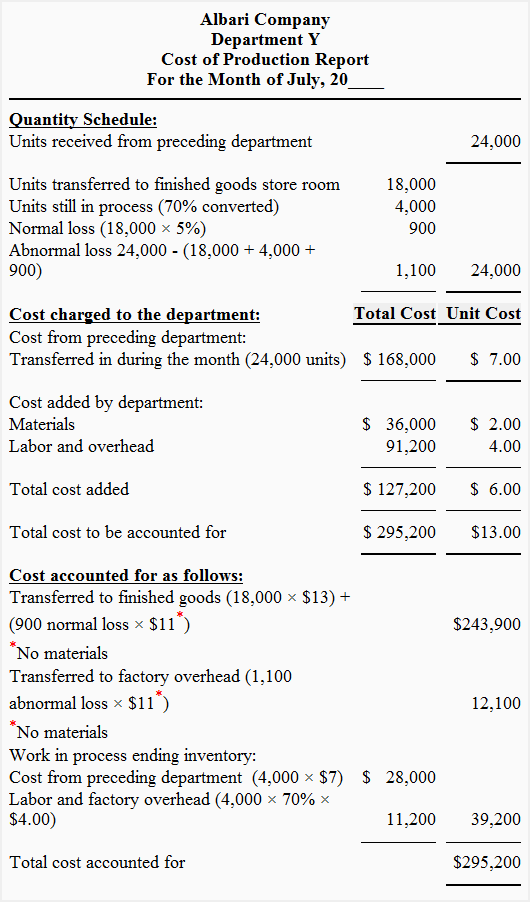

Exercise 18 (a)

The quantity and cost data belonging to Department Y of Albari Company for the month of July is presented below:

Quantity data:

- Units received from department X: 24,000

- Units transferred to finished goods store room: 18,000

- Units in ending inventory (70% converted): 4,000

- Expected normal loss: 5% of good output

- Abnormal loss: ?

Cost data:

- Cost of units received from Department X: $168,000

- Cost incurred in Department Y: Materials: $36,000, labor and factory overhead: $91,200

In Department Y, conversion costs are incurred uniformly throughout the process. Materials are added at the end of the process, following inspection.

Required: Prepare a cost of production report for Department Y of Albari Company.

Solution

Equivalent units:

Materials:

= 18,000 units

Labor and factory overhead:

= 18,000 + (4,000 × 70%) + *900 + 1,100**

= 22,800 units

*Normal loss: 18,000 × 5%

= 900

**Abnormal loss: Total units received from preceding department – (units transferred to finished goods + Ending inventory – Normal loss)

= 24,000 – (18,000 + 4,000 + 900)

= 1,100

Unit cost

Materials:

= $36,000/18,000 units

= $2.00 per equivalent unit

Labor and factory overhead:

= $91,200/22,800 units

= $4.00 per equivalent unit

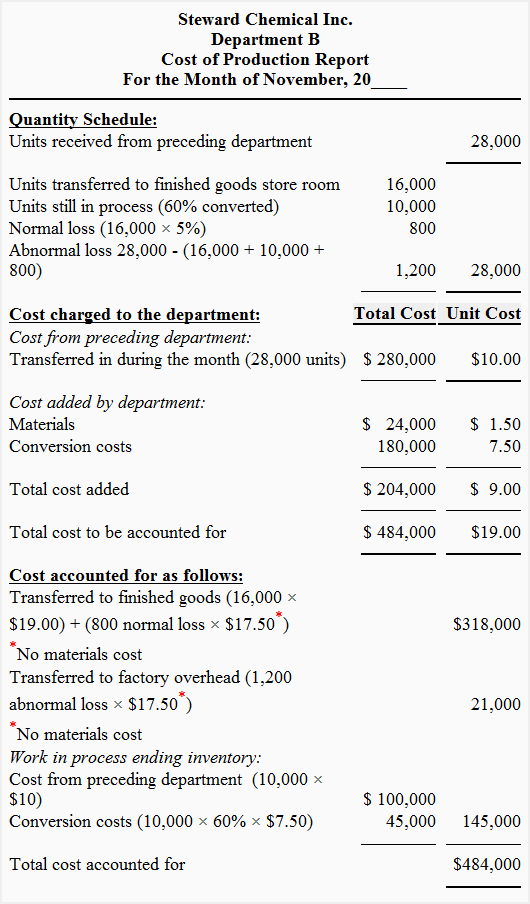

Exercise 18 (b)

Steward Chemicals Inc. uses a process costing system. During November, Department B received 28,000 units from Department A at a total cost of $280,000. The following costs were added by Department B during the month:

- Materials: $24,000

- Conversion cost: $180,000

During November, Department B completed 16,000 units and transferred the same to the finished goods storeroom. 10,000 units were still in process in Department B at the end of the month. These units were estimated to be 60% complete with respect to conversion cost.

Materials are added after inspection and identification of losses, which take place at the end of the process. Normal spoilage is expected to be only 5% of good units. Any spoilage above 5% of good output is considered an abnormal loss and is charged to factory overhead.

Required: Prepare a cost of production report of Department B of Steward Chemicals Inc.

Solution

Equivalent units

Materials:

= 16,000 units

Conversion costs:

16,000 + (10,000 × 60%) + *800 + 1,200**

= 24,000 units

*Normal loss: 16,000 × 5%

= 800

**Abnormal loss: Total units received from preceding department – (units transferred to finished goods + Ending inventory – Normal loss)

= 28,000 – (16,000 + 10,000 + 800)

= 1,200

Unit cost

Materials:

= $24,000/16,000 units

= $1.50 per equivalent unit

Conversion costs:

= $180,000/24,000 units

= 7.50 per equivalent unit

In problem 5 (a) and (b):

- The normal loss identified at the end of the process has been charged to good units transferred to the finished goods storeroom.

- The abnormal loss identified at the end of the process has been charged to factory overhead.

Leave a comment