Exercise-11: Joint product costing – constant gross margin percentage method

Exercise-11 (a):

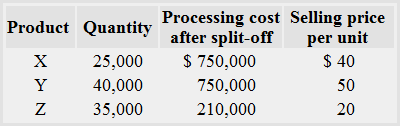

Northern Company manufactures three products at a joint production cost of $1,250,000. The Data for the month of January is provided to you:

Required: Allocate the joint production cost to products X, Y and Z using constant gross margin percentage method.

Solution

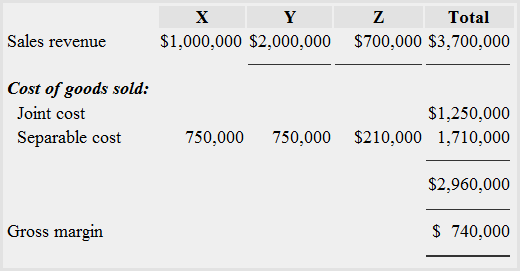

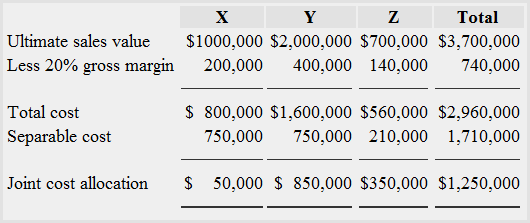

Gross margin percentage = Gross margin/Sales revenue

= $740,000/$3,700,000

= 0.2 or 20%

Exercise-11 (b):

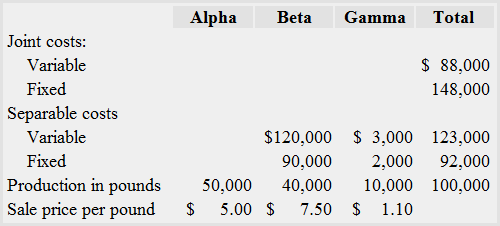

Smart Company produces three products – Alpha, Beta and Gama. Alpha and Beta are main products where as Gama is a by-product. Alpha is sold immediately after split-off but Beta and Gama require additional processing before sale. The data for the last year is given below:

The company deducts net revenue of by-product from manufacturing cost of the main products. The joint production cost is allocated to joint products to achieve the same percentage of gross profit for each product.

In Star Company, no spoilage of direct materials occurs during the normal course of production. The variable costs change in direct proportion to the quantity of finished goods produced. There were no finished goods and direct materials inventories at the start and end of the last year.

Required

- What is the total gross profit of joint products Alpha and Beta?

- Allocate the joint cost to joint products Alpha and Beta.

- Compute the gross profit of joint products Alpha and Beta.

Solution

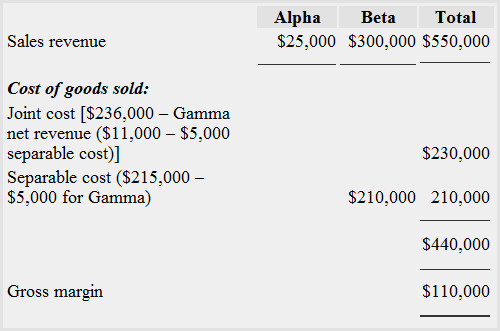

1. Total gross profit of Joint products

Gross margin percentage = Gross margin/Sales revenue

= $110,000/$550,000

= 0.2 or 20%

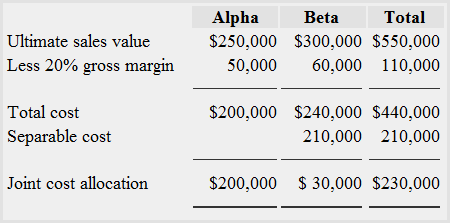

2. Allocation of joint cost to Alpha and Beta

3. Gross profit of Alpha and Beta:

The gross profit of Alpha is $50,000 and Beta is $60,000 (See line 2 of requirement 2).

Leave a comment