Price-to-earnings ratio (P/E ratio)

The price-to-earnings ratio (P/E ratio) compares the current market price of a company’s stock with its earnings per share and provides insights into the value the market attaches to the earnings of the company. In simple words, it gauges what the market is currently willing to pay for a single share in the company compared to its earnings.

P/E ratio is one of the closely watched financial metrics and is widely used by equity investors as a key component in their overall investment decisions. Since price-to-earnings ratio reveals the number of times a stock’s price is currently higher than its per share earnings, investors and analysts sometime refer it to as earnings multiple and price multiple.

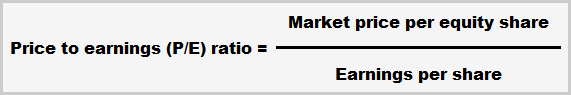

Formula

Price-to-earnings ratio is obtained by dividing the current market price of an ordinary share by earnings per share (EPS) of the company. The formula of P/E ratio is given below:

The two components of the P/E ratio formula are market price per equity share and earnings per share (EPS) of the company. The market price of a stock is the price at which its shares are currently being traded in the market. It generally fluctuates many times throughout the day, mainly due to demand and supply forces.

For the purpose of computing P/E ratio, the market price is the price at which a stock is open for sale at a given time and is generally mentioned alongside the company’s stock symbol (also known as ticker symbol). A stock or ticker symbol is a short code consisting of letters and numbers which helps identify the stock and its issuing company in a stock exchange. Each company picks its own unique symbol based on its availability in the exchange.

To obtain the EPS number of a public company, the analyst needs to access its published income statement. Public companies generally report this number at the bottom of their income statement, below the net income line.

Let’s illustrate the calculation of price-to-earnings ratio through an example.

Examples of price-to-earnings ratio

Example 1

The market price of an ordinary share of Roberts Company is $50 and its earnings per share is $5 for the year 2022. Compute the price-to-earnings ratio (P/E ratio) of Roberts Company.

Solution:

P/E ratio = Market price per share/EPS

= $50 / $5

= 10

The price-to-earnings ratio of Roberts is 10 which means company’s stock is selling for 10 times of its current EPS. Stating it another way, $1 of Roberts’ earnings currently has a market value of $10.

Example 2

Master Inc., a US based company, has a P/E ratio of 10 and reports an EPS for the current year of $2.50, at what price the Master’s stock would be selling in the market?

Solution

Market price per share = P/E ratio x EPS

= 10 x $2.50

= $25

According to formula, a stock with P/E ratio of 10 and current EPS of $2.50 would be selling for $20 per share.

Example 3

An exercise in your homework assignments requires you to calculate the estimated EPS of a retail company. The text in the exercise tells you that the company’s price-to-earnings ratio is 25 and its stock is currently selling at $125 per share in the market. What would be the EPS of the retail company?

Solution

EPS = Market price per share/Price-to-earnings ratio

= $125/25

= $5

By definition, a stock with P/E ratio of 25 and market price of $125 would have an EPS of $5.

Trailing vs forward P/E ratio

There are two versions of P/E ratio – a trailing and a forward P/E ratio. The trailing P/E ratio is calculated by using the EPS number based on the actual earnings of immediate past 12-month period. This is considered the standard or default form of the ratio. When we simply say the “P/E ratio”, we mean the trailing P/E ratio. The ratio referred in above examples is also the trailing P/E ratio.

Since trailing P/E ratio is based on the entity’s most recent actual earnings, it is considered a more reliable metric as compared to forward P/E ratio. However, decision-oriented analysts argue that it is based on the historical data and is not a concrete signal of future performance. They, therefore, insist to use it in conjunction with forward P/E ratio.

The forward P/E ratio (also referred to as estimated P/E ratio) uses the EPS number based on estimated earnings of forthcoming 12-month period. It incorporates all the factors that could possibly affect the entity’s future performance into its current earnings level. Many of the projections made for forward P/E ratio are also often valid for competing firms and, therefore, provide valuable insights into the future performance of industry as a whole.

Some companies project their forward P/E ratio but don’t widely communicate it because the ratio number may change as they amend their estimates for future performance. Since this version of the ratio relies on estimates for EPS number, it may be susceptible to bias and miscalculations.

Significance and interpretation of price-to-earnings (P/E) ratio

The price-to-earnings ratio tells analysts the amount of money a general investor might be willing to invest in the company for each dollar of its net earnings. It, therefore, can be a useful tool for financial forecasting.

P/E ratio also helps investors evaluate if the market price of a stock’s share is reasonable, undervalued or overvalued. For example, suppose, the current market price of a share of Vulture Limited is $60, its earnings per share is $10 and P/E ratio is 6 ($60/$10). Now, suppose further that the price-to-earnings ratio of other companies engaged in the same activities within the industry is around 8. If we compare these numbers, we realize that the market value of a share of Vulture should be $80 (i.e., 8 × $10). Assuming all things equal and no apparent negative aspect of Vulture, we can conclude that its share is still undervalued by $20 in relation to its industry.

Along with other indicators, a price-to-earnings ratio comparison of multiple companies, like the one given above, may guide investors in finding investment opportunities that might be potentially viable for them.

Now, we look at the other side. Suppose, If the P/E ratio of other similar companies is around 4 rather than 8, then a reasonable market value of Vulture’s share should be $40 ($4 × $10) rather than $60. The share of Vulture’s stock is, therefore, currently overvalued by $20 in relation to overall industry.

A high P/E ratio reflects that the investors are tending to pay much more to buy a stock’s share than it actually earns in profit. A common reason for this overspending is the investors’ belief of faster growth of the company and its stock. The general examples of companies with high price-to-earnings ratio include new tech businesses started with large amount of investment capital.

A low ratio might signify a slower growth but it does not necessarily indicate a weakness or failure. It, in fact, may mean that the company’s market share is reaching the maturity and it is time to look for new opportunities for further growth.

The price-to-earnings ratio differs from industry to industry. If you want to know whether a particular P/E ratio number is low or high, you need to look at the industry to which the firm belongs. A quick way to get the general idea is to compare the ratio with the industry’s average P/E metric.

Im loving this lesson, maybe if it’s possible could i be sent some more lessons/tests and information on this great subject as I’m picking it up regardless of my slight deslexia problem I’m determined to succeed and just need bit more practices,

Thank u for your time

D