Post-closing trial balance

The post-closing trial balance (also known as the after-closing trial balance) is the ninth and last step of the accounting cycle, which is prepared after making and posting all necessary closing entries to relevant ledger accounts. Since closing entries close all temporary ledger accounts, the post-closing trial balance consists of only permanent ledger accounts (i.e., balance sheet accounts). The purpose of preparing a post-closing trial balance is to assure that accounts are in balance and ready for recording transactions in the next accounting period.

Example

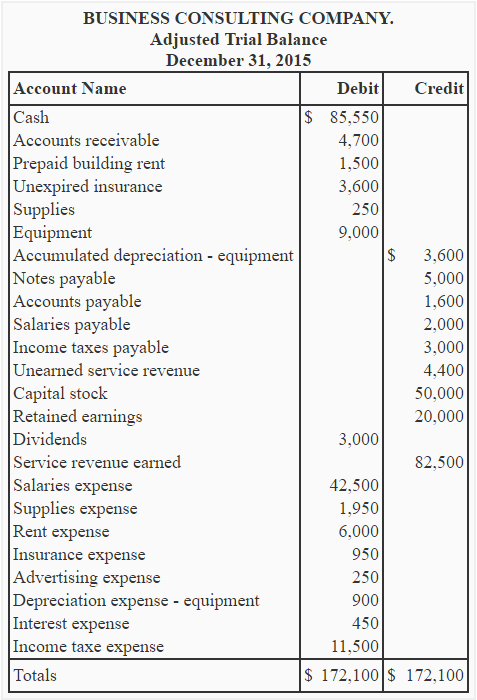

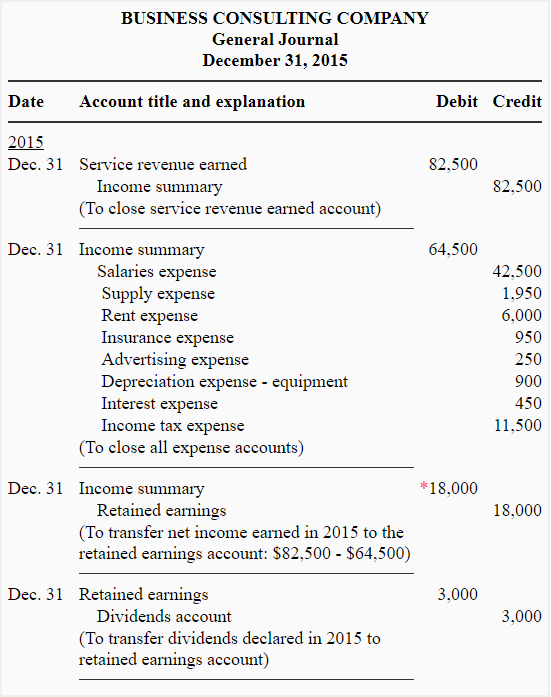

Adjusted trial balance and closing entries of Business Consulting Company are given below:

*$82,500 – $64,500

Required: Using the information from the adjusted trial balance and closing entries given above, prepare the post-closing trial balance of Business Consulting Company.

Solution

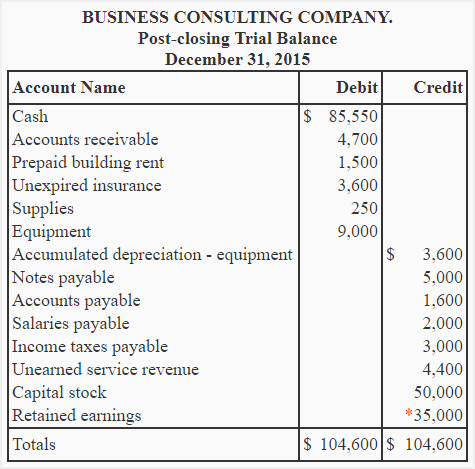

*Balance of retained earnings account has been updated as follows:

Retained earnings as per adjusted trial balance + Net income – Dividends

= $20,000 + $18,000 – $3,000

= $35,000

Notice that the post-closing trial balance prepared above lists only permanent or balance sheet accounts. The balances of all temporary accounts (i.e., revenue, expense, dividend, and income summary accounts) have turned to zero because of the above mentioned closing entries. These temporary accounts have therefore not been listed in the post-closing trial balance.

With the preparation of the post-closing trial balance, the accounting cycle for an accounting period comes to an end. In the next accounting period, this cycle starts again with the first step, i.e., the preparation of journal entries.

The notes given are comprehensive and educative. Is there any site for these topics to be downloaded?

How can I receive the payment