Payback method

Under payback method, an investment project is accepted or rejected on the basis of payback period. Payback period means the period of time that a project requires to recover the money invested in it. It is mostly expressed in months and years.

Unlike net present value , profitability index and internal rate of return method, payback method does not take into account the time value of money. A modified variant of this method is the discounted payback method which considers the time value of money. You can read about that variant here.

According to payback method, the project that promises a quick recovery of initial investment is considered desirable. If the payback period of a project is shorter than or equal to the management’s maximum desired payback period, the project is accepted, otherwise rejected. For example, if a company wants to recoup the cost of a machine within 5 years of purchase, the maximum desired payback period of the company would be 5 years. The purchase of machine would be desirable if it promises a payback period of 5 years or less.

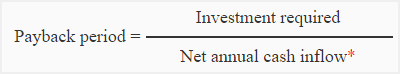

Payback period formula for even cash flow:

When net annual cash inflow is even (i.e., same cash flow every period), the payback period of the project can be computed by simply dividing the initial investment by the annual inflow of cash, as shown by the following formula:

*The denominator of the formula becomes incremental cash flow if an old asset (e.g., machine or equipment etc.) is replaced by a new one.

Example 1:

Delta Company is planning to purchase a machine known as machine X. Machine X would cost $25,000 and would have a useful life of 10 years with zero salvage value. The expected annual cash inflow of the machine is $10,000.

Required: Compute payback period of machine X and conclude whether or not the machine would be purchased if the maximum desired payback period of Delta company is 3 years.

Solution:

Since the annual cash inflow is even in this project, we can simply divide the initial investment by the annual cash inflow to compute the payback period. It is shown below:

Payback period = $25,000/$10,000

= 2.5 years

According to payback period analysis, the purchase of machine X is desirable because its payback period is 2.5 years which is shorter than the maximum payback period of the company.

Example 2:

Due to increased demand, the management of Rani Beverage Company is considering to purchase a new equipment to increase the production and revenues. The useful life of the equipment is 10 years and the company’s maximum desired payback period is 4 years. The inflow and outflow of cash associated with the new equipment is given below:

Initial cost of equipment: $37,500

Annual cash inflows:

Sales: $75,000

Annual cash Outflows:

Cost of ingredients: $45,000

Salaries expenses: $13,500

Maintenance expenses: $1,500

Non cash expenses:

Depreciation expense: $5,000

Required: Should Rani Beverage Company purchase the new equipment? Use payback method for your answer.

Solution:

Step 1: In order to compute the payback period of the equipment, we need to workout the net annual cash inflow by deducting the total of cash outflow from the total of cash inflow associated with the equipment.

Computation of net annual cash inflow:

$75,000 – ($45,000 + $13,500 + $1,500)

= $15,000

Step 2: Now, the amount of investment required to purchase the equipment would be divided by the amount of net annual cash inflow (computed in step 1) to find the payback period of the equipment.

= $37,500/$15,000

=2.5 years

Depreciation is a non-cash expense and therefore has been ignored while calculating the payback period of the project.

According to payback method, the equipment should be purchased because the payback period of the equipment is 2.5 years which is shorter than the maximum desired payback period of 4 years.

Comparison of two or more alternatives – choosing from several alternative projects:

Where funds are limited and several alternative projects are being considered, the project with the shortest payback period is preferred. It is explained with the help of the following example:

Example 3:

The management of Health Supplement Inc. wants to reduce its labor cost by installing a new machine in its production process. For this purpose, two types of machines are available in the market – Machine X and Machine Y. Machine X would cost $18,000 where as Machine Y would cost $15,000. Both the machines can reduce annual labor cost by $3,000.

Required: Which is the best machine to purchase according to payback method of project analysis?

(Hint: Consider the reduction in cost as equivalent to cash inflow).

Solution:

Payback period of machine X: $18,000/$3,000 = 6 years

Payback period of machine Y: $15,000/$3,000 = 5 years

According to payback method, machine Y is more desirable than machine X because it has a shorter payback period than machine X.

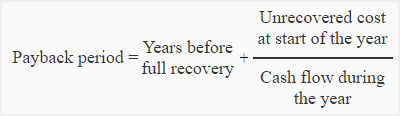

Payback method with uneven cash flow:

In above examples, we have assumed that the projects generate even or consistent cash inflow. However, it generally does not happen as many projects mostly generate uneven or inconsistent cash inflow. When projects generate inconsistent or uneven cash inflow (i.e., different cash inflow in different periods), the simple formula given above cannot be used to determine the payback period. In such situations, we need to compute the cumulative cash inflow and then apply the following formula:

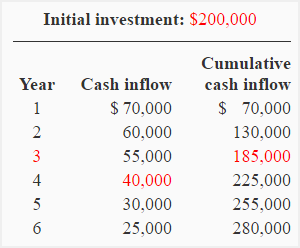

Example 4:

An investment of $200,000 is expected to generate the following cash inflows in six years:

Year 1: $70,000

Year 2: $60,000

Year 3: $55,000

Year 4: $40,000

Year 5: $30,000

Year 6: $25,000

Required: Compute payback period of the investment. Should the investment be made if management wants to recover the initial investment in 3 years or less?

Solution:

(1). Because the cash inflow is uneven, the payback period formula cannot be used to compute the payback period. We can compute the payback period by computing the cumulative net cash flow as follows:

Payback period = 3 + (15,000*/40,000)

= 3 + 0.375

= 3.375 Years

*Unrecovered investment at start of 4th year:

= Initial cost – Cumulative cash inflow at the end of 3rd year

= $200,000 – $185,000

= $15,000

The payback period for this project is 3.375 years which is longer than the maximum desired payback period of the management (3 years). The investment in this project is therefore not desirable.

Advantages and disadvantages of payback method:

Some advantages and disadvantages of payback method are given below:

Advantages:

- An investment project with a short payback period promises a quick inflow of cash. It is therefore, a useful capital budgeting method for cash poor firms.

- A project with short payback period can improve the liquidity position of the business quickly. The payback period is important for the firms for which liquidity is very important.

- An investment with short payback period makes the funds available soon to invest in another project.

- A short payback period reduces the risk of loss caused by changing economic conditions and other unavoidable reasons.

- Payback period is very easy to compute and apply.

Disadvantages:

- The payback method does not take into account the time value of money.

- It does not consider the useful life of the assets and inflow of cash that the project may generate after its payback period. For example, two projects, project A and project B, both require an initial investment of $5,000. Project A generates an annual cash inflow of $1,000 for 5 years whereas project B also generates an annual cash inflow of $1,000 but for 7 years. It is clear that the project B is going to be more profitable than project A, but according to payback method, both the projects are equally desirable, because both have a payback period of 5 years (= $5,000/$1,000).

This is so helpful to me