Converting accounts receivable to notes receivable

Definition and explanation:

Note receivable is a formal promissory note that is written by a debtor in favor of a creditor. It is a legal document in which debtor makes an unconditional promise to pay on demand or at a future date a certain sum of money to a creditor. After writing the note, the debtor signs and gives it to the creditor. On the completion of this procedure, an account receivable is converted into note receivable.

The person who signs the note (i.e., debtor) is known as the maker of the note and the person to whom he promises to make the payment (i.e., creditor) is known as the payee.

At the date of maturity, the payee presents the note to the maker for payment of the face value of the note as well as interest thereon.

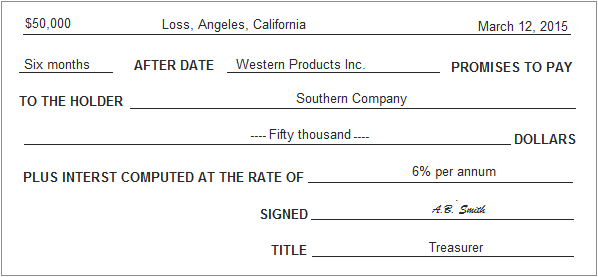

Format of note receivable/promissory note

A simplified format of promissory note is given below:

Benefits of notes receivable/promissory note

Some companies prefer to convert their accounts receivable (debtors) into notes receivable. They do so because of the following benefits of notes receivable.

- Firstly, a note receivable earns interest revenue on the outstanding amount whereas account receivable does not earn any such revenue.

- Secondly, it works as an additional proof in the court of law if maker defaults or refuses to make the payment.

- Thirdly, it is a negotiable instrument that can be transferred to third parties for the settlement of a payment.

- Fourthly, it is usually considered as good as money.

Is there a fasb guidance to support being allowed to convert accounts receivable to notes receivable