Normal or conventional cash flow

Definition and explanation

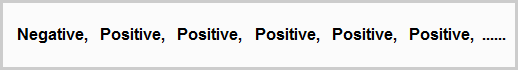

The term normal cash flow (also known as conventional cash flow) refers a stream of negative and positive cash flows for a specific period in which the direction of cash flow changes only once. In capital budgeting, it typically comprises of a negative cash flow in the form of initial investment at the time of implementation of a project or investment and then a series of consecutive positive cash flows over the life of the project or investment. The general pattern of a normal or conventional cash flow is shown below:

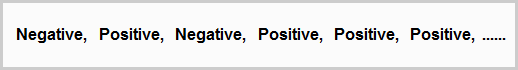

The key point in the concept is the direction of cash flow which changes only once in case of normal cash flow. The opposite of this pattern is the non-normal or unconventional cash flow which changes its direction more than once over the period concerned. An example pattern of such cash flow is given below:

Examples of normal or conventional cash flow

Example 1

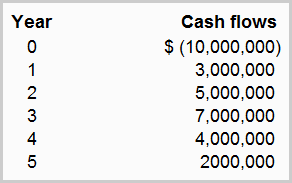

Armstrong Inc. has forecasted the following cash flows for its forthcoming project with a five years life period:

The cash flow in above project is a normal cash flow because an initial investment is followed by a series of five positive cash flows only.

The project starts with a cash outlay of $10 million in year 0, which is the initial investment period of the project. After then, it generates five consecutive cash flows of 3 million, 5 million, 7 million, 4 million and 2 million in year 1, 2, 3, 4 and 5 respectively. Notice that the direction of cash flow is negative in year 0 which turns to positive in year 1 and continues to remain positive for the five year life of the project.

Example 2

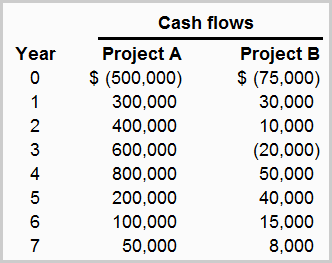

Consider the cash flow pattern of two projects are given in the following table:

Project A’s cash flow changes its direction only once (in year 1) and after then it continues to remain positive until the end of 7-year life of the project. This cash flow is, therefore, a normal or conventional cash flow.

Project B’s cash flow changes its direction thrice (in year 1, 3 and 4) over the life of the project. This cash flow is, therefore, a non-normal or unconventional cash flow.

How does cash flow pattern impact the IRR?

In capital budgeting, the pattern of cash flow is very important. A normal cash flow always results in a single IRR which the managers can compare against the company’s minimum rate of return or hurdle rate to determine the financial attractiveness of the proposal.

If, on the other hand, the cash flow pattern is non-normal or unconventional, it arises multiple IRR problem and causes a decision uncertainty for managers. For example, if a project promises two different rates of return and managers are uncertain about which one of them might prevail, they would lose their confidence to go ahead with the proposal.

Leave a comment