Non-cash investing and financing activities

The statement of cash flows reports only those operating, investing, and financing activities that affect cash and cash equivalents. However, some non-cash investing and financing activities may be very important for the users of financial statements because they may have a significant impact on the entity’s current and future performance in terms of revenues, profits, and the ability to generate positive cash flows. Therefore, both IFRS and US GAAP require companies to disclose all significant non-cash investing and financing activities either at the bottom of the statement of cash flows as a footnote or in the notes to the financial statements.

Examples:

Some examples of non-cash investing and financing activities that may become significant for the users of financial statements are given below:

- Issuance of stock to retire a debt

- Purchase of an asset by issuing stock, bonds or a note payable.

- Exchange of non-cash assets.

- Conversion of debt to common stock.

- Conversion of preferred stock to common stock.

- Payment for services availed by issuing stock in lieu of cash

Disclosure of non-cash investing and financing activities

The general approach is to disclose a schedule of non-cash investing and financing activities at the bottom of the statement of cash flows. They can, however, also be included as a separate schedule or in the notes to the financial statements. Both approaches are in practice, and both are in accordance with IFRS and US-GAAP. The acceptable disclosure of these activities is illustrated below:

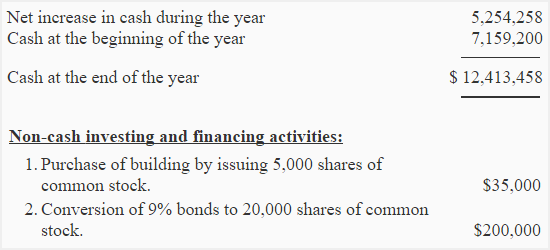

(1). Disclosure as foot note at the bottom of the statement of cash flows:

The following presentation shows a schedule of significant non-cash investing and financing activities at the bottom of the statement of cash flows:

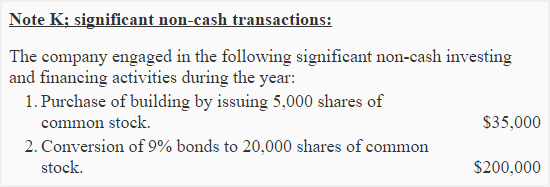

(2). Disclosure in a separate note:

The following is an example of the disclosure of significant non-cash investing and financing activities as a separate note to the financial statements:

Leave a comment