Market or sales value method of joint cost allocation

Under market or sales value method, the joint cost incurred in a joint production process is allocated to different joint products on the basis of their market or sales value.

The method refers to a systematic allocation of joint cost attached to a specific joint production process based upon the real market or sales value of the products that come into existence as a result of running that joint production process. The method makes use of a weighted average of market values of all the joint products and the cost is apportioned amongst the products based on their respective shares of sales values.

The market value method is an industry preferred method for allocating joint cost among joint products because the market or sales value of any product is considered one of the most reliable indicator of its economic value and the costs attached to it.

Example 1

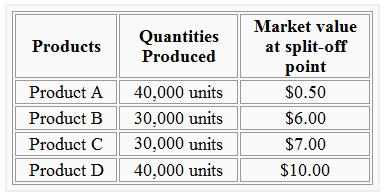

The Steven Company produces four products – product A, product B, product C and product D. These four products are produced from a single raw material using a joint production process. All the products have a market value at split-off point and can be sold to customers without any further processing. The total joint cost incurred in the most recent production run is $486,000. The quantities produced of four products and their market or sales values per unit at split-off point are given below:

Required: Allocate joint cost among four joint products using market value method.

Solution

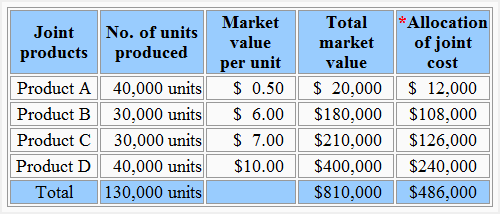

*Total joint cost is 60% of the total market value of all joint products

($486,000/$810,000) × 100 = 60%

The allocation of joint cost on the basis of market value at split-off point has been made as follows:

- Product A: $20,000 × 0.6 = $12,000

- Product B: $180,000 × 0.6 = $108,000

- Product C: $210,000 × 0.6 = $126,000

- Product D: $400,000 × 0.6 = $240,000

Cost after split-off point

Some products may require further processing after split-off point before they can be sold in the market. Such products may not have a market value at the split-off point. In such situations, the joint cost is allocated on the basis of a hypothetical market value at split-off point which is equal to the ultimate sales or market value of the product less processing cost incurred on individual products after split-off point.

The formula for calculating hypothetical market value of a product at its split-off point can be written as follow:

Hypothetical market value at split-off point = Ultimate market value – Processing cost after split-off point

The use of hypothetical market value for proration of joint cost among joint products is illustrated in example 2 below:

Example 2

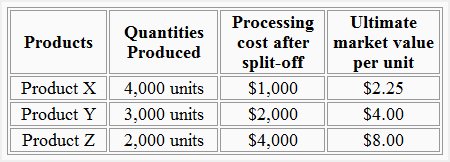

The Robert Company produces three products – product X, product Y and product Z. These products are produced from a single raw material in a joint production process. The products do not have a market value at split-off point and require a further processing to place them in the saleable condition. The joint production cost for a recently completed production run is $16,500. Other relevant data is given below:

Required: Allocate joint production cost to joint products assuming the Robert company uses a market value method of joint cost allocation.

Solution

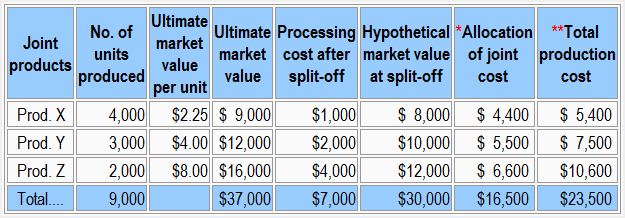

*Total joint cost is 55% of the total hypothetical market value of all joint products:

($16,500/$30,000) × 100 = 55%

The allocation of total joint cost on the basis of hypothetical market value at split-off point has been made as follows:

- Product X: $8,000 × 0.55 = $4,400

- Product Y: $10,000 × 0.55 = $5,500

- Product Z: $12,000 × 0.55 = $6,600

**Total production cost:

- Product X: $4,400 + $1,000 = $5,400

- Product Y: $5,500 + $2,000 = $7,500

- Product Z: $6,600 + $4,000 = $10,600

Molasses are the by product at our sugar manufacturing and we consider the cost of molasses are zero. For the sales value Molasses, which of the following approaches I can adapted :

1. Approach-a: The sales revenue of by-product is listed on the income statement as other income.

2. Approach-b: The sales revenue of by-product is listed on the income statement as additional revenue.

3. Approach-c: The sales revenue of by-product is listed as a deduction from the cost of goods sold (COGS) of the main product.

4. Approach-d: Sales revenue of by product is listed as a deduction from the total manufacturing cost of the main product.

If you don’t allocate any portion of the joint cost to your by-product, then any of the approaches you mentioned above can be adopted.

Ok thanks