Last-in, first-out (LIFO) method in a perpetual inventory system

In contrast to first-in, first-out (FIFO) method, the last-in, first-out (LIFO) method of inventory valuation assumes that the last costs incurred to purchase merchandise or direct materials are first costs charged against revenues. In other words, it assumes that the cost of merchandise sold (in a merchandising company) or the cost of materials issued to production department (in a manufacturing company) is the cost of most recent purchases.

Like first-in, first-out (FIFO), last-in, first-out (LIFO) method can be used in both perpetual inventory system and periodic inventory system. The following example explains the use of LIFO method for computing cost of goods sold and the cost of ending inventory in a perpetual inventory system.

Example 1 – LIFO perpetual inventory system in a merchandising company:

BZU uses perpetual inventory system to record purchases and sales and LIFO method to valuate its inventories. The company has provided the following information about commodity DX-13C and wants your assistance in computing the cost of commodity DX-13C sold and the cost of ending inventory of commodity DX-13C.

- Aug. 01: Beginning inventory; 20 units @ $40 per unit.

- Aug. 07: Sales; 14 units.

- Aug. 12: Purchases; 16 units @ $42 per unit.

- Aug. 17: Sales; 8 units.

- Aug. 23: Sales; 4 units.

- Aug. 27: Purchases; 8 units @ $44 per unit.

- Aug. 30: Sales; 10 units.

Required:

- Prepare a LIFO perpetual inventory card.

- Compute cost of goods sold and cost of ending inventory using LIFO method.

Solution:

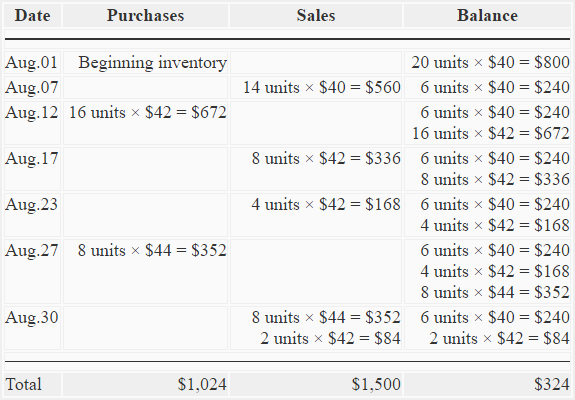

(1). LIFO perpetual inventory card:

(2). Cost of goods sold (COGS) and ending inventory:

LIFO perpetual inventory card (prepared above) can help compute cost of goods sold and ending inventory.

a. Cost of goods sold (COGS): $560 + $336 + $168 + $436 = $1,500

b. Ending inventory: [$240 + $84] = $324

When LIFO method is used in a perpetual inventory system, it is typically known as “LIFO perpetual system”.

The above example explains the use of LIFO perpetual system in a merchandising company. In manufacturing companies, it is used to compute the cost of materials issued to production and cost of ending inventory of raw materials (also known as direct materials). Consider the following example:

Example 2 – LIFO perpetual system in a manufacturing company:

Three Star company manufactures product X. Material K5 is used to manufacture product X. The information about the acquisition and issuance of material K5 for the month of June is given below:

- Jun. 01: Beginning inventory; 50 kgs @ $4.80/kg and 100 kg @ $5.00/kg.

- Jun. 05: 10 kgs of material K5 were returned to supplier.

- Jun. 09: 35 kgs of material K5 were issued to factory.

- Jun. 12: 70 kgs of material K5 were purchased @ $5.10/kg.

- Jun. 17: 50 kgs of material K5 were issued to factory.

- Jun. 19: 25 kgs of material K5 were issued to factory.

- Jun. 23: 50 kgs of material K5 were purchased @ $5.20/kg

- Jun. 26: 60 kgs of material K5 were issued to factory.

- Jun. 30: 5 kgs of material K5 were returned from factory to store room.

A perpetual inventory system is used to account for acquisition and issuance of direct materials.

Required: Compute the cost of material K5 issued to factory and the cost of material K5 at the end of June using last-in, first-out (LIFO) method.

Solution:

As the company uses perpetual inventory system, a materials ledger card would be prepared to compute the cost of materials issued to factory and the cost of materials on hand at the end of the month. Materials ledger card is similar to inventory card prepared above. Materials ledger card of Three Star company is give below:

(1). LIFO perpetual material card:

* Materials returned from store room to supplier is usually recorded in purchases column and materials returned from factory to store room is usually written in issues column. The returns are normally written in red ink to differentiate them from normal purchases and issues.

(2). Cost of material issued to factory:

= $175 + $255 + $102 + $25 + $260 + $50 – $25*

= $842

*Material returned from factory to store room

(3). Cost of material in hand on June 30th:

= $240 + $225

= $465

Leave a comment