Journal entries in the books of consignee

In consignment, the status of consignee is that of a commission agent. His income is the commission which he receives from consignor for the sale of goods dispatched to him. He has no share in the consignment profit because he is not a business owner or partner. Similarly, he is also not responsible for any loss incurred by the consignment business.

Any expenses incurred by the consignee in connection with the consignment are reimbursed to him. Most often he deducts these expenses from sale proceeds along with his earned commission.

Journal entries and ledger accounts in the books of consignee

Journal entries:

We will first discuss the journal entries that are made in the books of consignee and then talk about the necessary ledger accounts the consignee needs to maintain. The common journal entries that a consignee makes in his books are given below:

1. Entry at the time of receiving goods:

No entry

The consignee holds goods on behalf of and on account of consignor. He does not make an accounting entry when he receives the goods consigned to him. He may however, keep the record of goods received in a separate book known as consignment inward book.

2. Entry at the time of making advance to the consignor:

(i). if payment is made in cash or via check or bank draft:

Consignor A/C [Dr]

Cash/Bank A/C [Cr]

(ii). If a bill is accepted as a mode of advance payment:

Consignor A/C [Dr]

Bill payable A/C [Cr]

3. Entry at the time of making payment for consignment related expenses:

Consignor A/C [Dr]

Cash/Bank A/C [Cr]

4. Entry at the time of sale of goods:

(i). If goods are sold for cash:

Cash/Bank A/C [Dr]

Consignor A/C [Cr]

(ii). If goods are sold on credit

See del credere commission and credit sales article

5. Entry for recording commission income:

Consignor A/C [Dr]

Commission received A/C [Cr]

6. Entry at the time of sending remittances:

Consignor A/C [Dr]

Cash/Bank A/C [Cr]

7. Entry to close commission received account to profit and loss account:

Profit and loss A/C [Dr]

Commission received A/C [A/C]

Points to remember:

- At the end of the accounting period, if consignor’s account shows a debit or credit balance, it should be presented in the balance sheet. Debit balance is shown as sundry debtors under the head current assets where as credit balance is shown as sundry creditors under the head current liabilities.

- No entry regarding the stock on consignment is passed in the books of consignee. As mentioned earlier, the consignee just holds the stock; the ownership to goods rests with the consignor.

- The consignee does not calculate profit or loss on consignment.

- The commission received account in the books of consignee is closed to the profit and loss account at the end of the year. It is done by making the journal entry 7 given above.

Ledger accounts:

The two ledger accounts that are important in the books of consignee are consignor account and commission received account. The consignor account is a personal account in nature. It tells consignee what balance is due to the consignor after deducting his commission and expenses from the sales proceeds. The commission received account is used to keep a record of the commission income earned from consignment sales. Consider the following example:

Example

Ahmad & Co. of Sialkot Consigned goods costing Rs 75,000 to Nasir & Co. of Karachi. Ahmad paid the following expenses:

- Loading charges: Rs 1,500

- Insurance: Rs 1,000

- Freight: Rs 5,000

Nasir & Co. received the delivery and transported the same to a rented godown. He paid the following expenses in respect of this consignment:

- Unloading charges: Rs 1,000

- Carriage: Rs 2,000

- Godown rent: Rs 2,500

On the same day, Nasir sent a bank draft of Rs 37,500 to Ahmad as advance against consignment.

Nasir sold all the goods for Rs 100,000. His commission was 10% on gross sale proceeds. He paid the balance due via bank draft.

Required: Prepare journal entries and ledger accounts in the books of consignee.

Solution

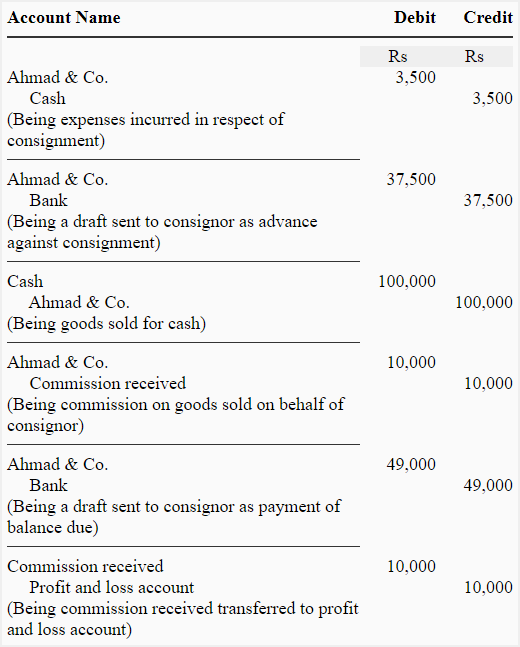

Journal entries in the books of consignee:

Ledger accounts in the books of consignee:

Leave a comment