Interest tax shield

Definition and explanation

Interest tax shield is the amount by which a taxpayer’s income tax liability decreases due to its interest expense. Like depreciation, the interest on debt borrowing is a tax admissible expense in many countries which reduces the entities’ taxable income and hence their income tax liability. The amount of interest tax shield can be estimated by multiplying the annual interest expense by the applicable tax rate of the entity.

For funding their expansion and growth plans, companies often prefer debt over equity capital. The reason is that the interest on debt capital is a tax admissible expense under most of the tax jurisdictions while the dividend paid on equity capital is not. The tax benefit could be surprisingly large when the company’s tax rate is higher, and it has a significant amount of interest-bearing debt in its capital structure.

The cash saved from reduced taxes could be diverted towards, payment of liabilities, business expansion, process upgradation or other valuable uses. The debt financing may, therefore, often prove to be much more advantageous than equity financing.

The concept of interest tax shield would not be applicable for companies whose tax jurisdiction does not permit the deduction of interest expense from their taxable income.

Formula

Interest tax shield available to an entity can be determined by multiplying its annual tax admissible interest expense by the applicable tax rate. Its formula or equation can be written as follows:

Interest tax shield = Tax admissible interest expense x Applicable tax rate

Example

Helium, a chemical processing company, has a total tax deductible interest expense of $100,000. Estimate the annual interest tax shield available to Helium if its applicable tax rate is 26%, 32% and 48%?

Solution

(1). ITS available if tax rate is 26%:

= $100,000 x 0.26

= $26,000

(2). ITS available if tax rate is 32%:

= $100,000 x 0.32

= $32,000

(3). ITS available if tax rate is 48%:

= $100,000 x 0.50

= $50,000

In above example, we can observe that the value of interest tax shield increases as the company’s tax rate increases. This is because, at three given tax rates of 26%, 32% and 48%, each dollar of interest expense saves Helium 26 cents, 32 cents and 48 cents in taxes respectively.

Likewise, the interest tax shield also increases as the amount of admissible interest expense increases. In above example, suppose, if Helium’s tax admissible interest expense increases to its double i.e., from $100,000 to $200,000, then the tax shield at all three assumed tax rates would also increase to its double i.e., $52,000, $64,000 and $100,000 respectively.

From above computations, it is apparent that the practicality and effectiveness of the concept would be higher at the higher amounts of interest and tax rates.

Interest tax shield analysis via income statement

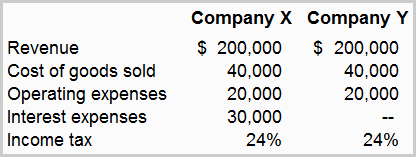

Let’s illustrate how the presence of interest-bearing debt impacts the amount of income tax as well as the income statement as a whole. For this purpose, we would construct and compare two separate income statements, one with interest expense and one without interest expense. The data to be used is as follows:

The interest expense of $30,000 under Company X’s data belongs to an outstanding debt. Company Y currently does not have any interest-bearing loan or debt in its capital structure.

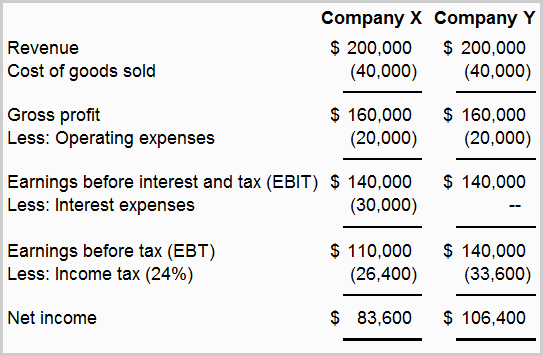

Let’s construct the income statements of two companies and make a comparison of both.

Notice that the financial numbers of both the companies up to EBIT line are the same. But after this line they begin to differ. Company X has reported an interest expense of $30,000 which it has deducted from its EBIT to report an EBT of $110,000. Company Y, on the other hand, has not reported any interest expense which reveals that it currently does not have any outstanding interest-bearing debt in its capital structure. The EBT number of Company Y is, therefore, the same as its EBIT number i.e., $140,000.

EBT, in this example, is the taxable income of companies. Given the same income tax rate of 24% for both the companies, Company X’s income tax is $26,400 and Company Y’s income tax is $33,600, which is $7,200 higher than Company X. This difference of $7,200 (= $33,600 – $26,400) represents the amount of interest tax shield available to Company X due to the presence of interest expense. We can also calculate it using formula as follows:

$30,000 x 0.24 = $7,200

After deducting the amount of applicable income tax, the EBT number leaves the net income of $83,600 for Company X and $106,400 for Company Y. Although company Y has reported a higher net income, Company X has availed a tax shield on account of its interest expense. With debt financing and reduced income tax, Company X would have more cash available to support its future development and growth plans.

Interest tax shield in net present value (NPV) calculation

For net present value (NPV) calculation, the interest tax shield is generally not treated as cash inflow instead its effect is reflected by using the after-tax cost of debt in weighted average cost of capital (WACC) computation. This adjustment lowers the WACC factor which ultimately results in higher NPV of cash flow. For example, if a company’s pre-tax cost of debt is 12% and its incremental tax rate is 25%, then its after-tax cost of debt to be used for WACC computation would be 9% [12% x (1 – 0.25)]. This practice automatically incorporates the effect of interest tax shield into the NPV computation.

If we want to determine the present value of total tax shield, we can do so by calculating the NPV using both pre-tax WACC and after-tax WACC and then find the difference between two values.

Interest tax shield = NPV with pre-tax WACC – NPV with after-tax WACC

Application of interest tax shield for individual persons

The concept of interest tax shield not only applies to commercial entities, but also to individual persons. For example, when an individual person obtains an interest bearing loan to purchases a residential house, he can reduce his tax burden by offsetting the interest on that loan against his taxable income.

A common reason of why governments grant interest tax shield to all commercial as well as individual entities is that they want to encourage more investments in their countries and/or states.

Leave a comment