Horizontal or trend analysis of financial statements

Horizontal analysis (also known as trend analysis) is a financial statement analysis technique that shows changes in the amounts of corresponding financial statement items over a period of time. It is a useful tool to evaluate the trend situations.

The statements for two or more periods are used in horizontal analysis. The earliest period is usually used as the base period and the items on the statements for all later periods are compared with items on the statements of the base period. The changes are generally shown both in dollars and percentage.

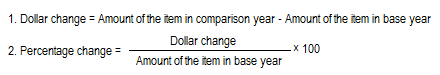

Dollar and percentage changes are computed by using the following formulas:

Horizontal analysis may be conducted for balance sheet, income statement, schedules of current and fixed assets and statement of retained earnings.

Example:

An example of the horizontal analysis of balance sheet, schedule of current assets , income statement and statement of retained earnings is given below:

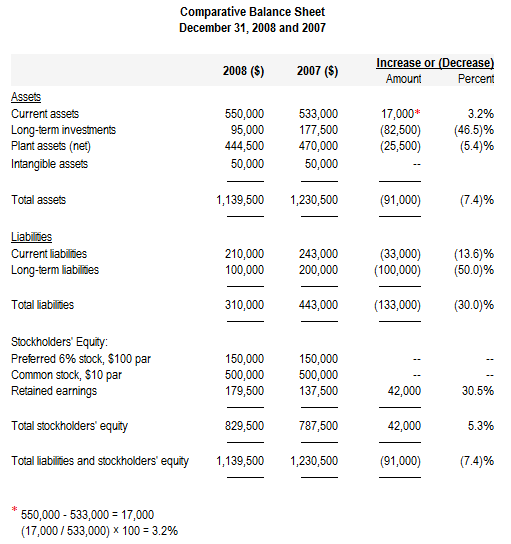

Comparative balance sheet with horizontal analysis:

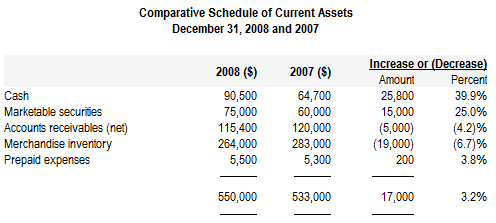

Comparative schedule of current assets:

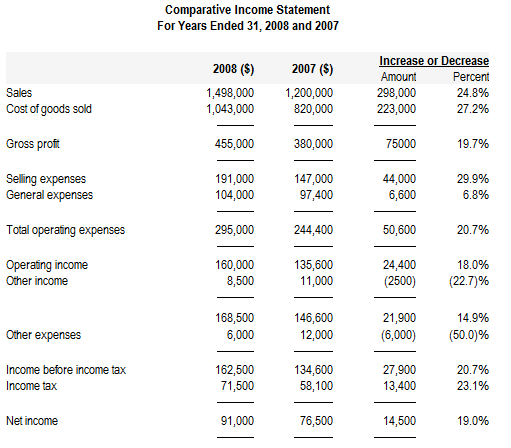

Comparative income statement with horizontal analysis:

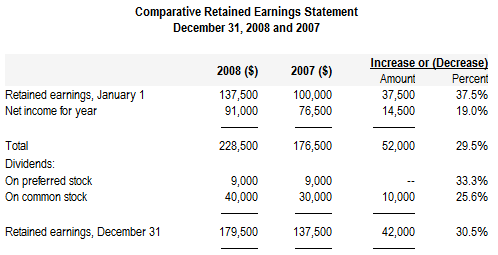

Comparative retained earnings statement with horizontal analysis:

In above analysis, 2007 is the base year and 2008 is the comparison year. All items on the balance sheet and income statement for the year 2008 have been compared with the items of balance sheet and income statement for the year 2007.

The actual changes in items are compared with the expected changes. For example, if management expects a 30% increase in sales revenue but actual increase is only 10%, it needs to be investigated.

Leave a comment