Fixed assets turnover ratio

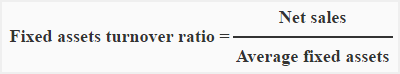

Fixed assets turnover ratio (also known as sales to fixed assets ratio) is a commonly used activity ratio that measures the efficiency with which a company uses its fixed or noncurrent assets to generate its sales revenue. It is computed by dividing net sales by average fixed assets.

Formula:

Note for students: Sometime opening balance of fixed assets may not be given in the question. In such case, closing balance of fixed assets may be used as the denominator of the formula, because the computation of average fixed assets would not be possible.

Let’s first illustrate the computation of fixed assets turnover ratio through an example and then go for ratio’s significance and interpretation section.

Example:

X and Y are two independent companies that manufacture office furniture and distribute it to the resellers as well as customers in various regions of USA . The selected data for both the companies is give below:

Net sales during the year:

X: $73,500

Y: $94,000

Net fixed assets at 1 January 2023:

X: $22,500

Y: $20,000

Net fixed assets at 31 December 2023:

X: $24,000

Y: $21,500

Required:

- Calculate fixed assets turnover ratio for both the companies.

- Can we compare the ratio of company X with that of Company Y? If yes, which company is more efficient in using its fixed assets?

Solution

(1). Calculation of fixed assets turnover ratio:

Company X:

73,500/23,250*

= 3.16

Company Y:

94,000/20,750*

= 4.53

*Average fixed assets:

X: (22,500 + 24,000)/2

Y: (20,000 + 21,500)/2

(2). Comparison of two companies:

The ratio of company X can be compared with that of company Y because both the companies belong to same industry. Generally speaking the comparability of ratios is more useful when the companies in question operate in the same industry.

Company Y generates a sales revenue of $4.53 for each dollar invested in its fixed assets whereas company X generates a sales revenue of $3.16 for each dollar invested in fixed assets. Company Y’s management is, therefore, more efficient than company X’s management in using its fixed assets.

Significance and interpretation:

Generally, a high fixed assets turnover ratio indicates better utilization of fixed assets and a low ratio means inefficient or under-utilization of fixed assets. The usefulness of this ratio can be increased by comparing it with the ratio of other companies, industry standards and past years’ ratio.

Leave a comment