Financial assets and their valuation

Definition and explanation:

Financial assets include cash and those assets that can be easily and quickly converted into known amount of cash. Normally, cash, short term investments (marketable securities) and receivables are included in the definition of financial assets.

Financial assets represent the most liquid assets of the business that can be used to pay interest on debts, pay taxes, and purchase inventory etc. The availability of sufficient financial assets ensures the strong liquidity position of the business.

Valuation of financial assets:

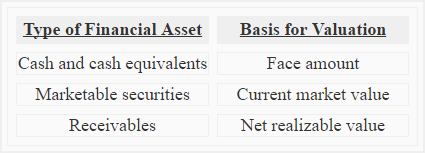

Financial assets are shown in the balance sheet at their current values. The current value of each financial asset is determined differently.

Cash

The cash is an asset in which other liquid assets are converted so it is shown in the balance sheet at face value.

Marketable securities

Marketable securities are shown at their current market value. The market value of marketable securities is affected by a number of factors such as interest rates and stock prices.

Receivables

Receivables are shown at their net realizable value. Net realizable value is the estimated collectible amount of receivables.

Summary:

Leave a comment