Exercise-7: Cash received from customers – T-account approach

Learning objective:

This exercise illustrates how to work out the amount of cash received from customers using the T-account approach.

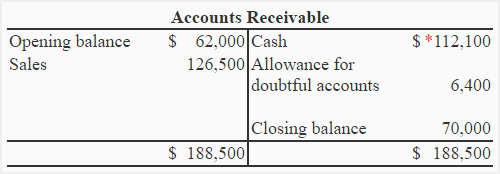

In the previous exercise, we used the formula approach to compute the cash received from customers. We can also work out this figure by making the “accounts receivable T-account”. In this exercise, we will use the data from Exercise No. 6 and calculate cash received from customers during the period using the T-account approach.

The following information belongs to Alpha Company:

- Accounts receivable on December 31, 2023: $62,000

- Accounts receivable on December 31, 2024: $70,000

- Allowance for doubtful accounts on December 31, 2023: $2,100

- Allowance for doubtful accounts on December 31, 2024: $3,200

- Sales for the year 2023: $155,300

- Sales for the year 2024: $126,500

The company sells goods on credit. For the year 2024, bad debt expense was $7,500 and accounts amounting to $6,400 were written-off.

Required: Find out the amount of cash collected from customers by Alpha Company using t-account approach.

Solution:

*Balancing figure – the cash received from customers.

Why does the closing balance lie on the credit side?