Exercise-6 (Gross method of recording purchases)

Posted in: Inventory costing methods (exercises)

United Company made the following transactions during the month of March:

- Mar.05: Purchased merchandise worth $21,600; credit terms were 2/20, n/45.

- Mar.08: Returned merchandise to vendor worth $5,000 (gross).

- Mar.20: Payment made for merchandise purchased on March 5.

The company uses gross method of recording purchases.

Required: Prepare journal entries to record the above transactions assuming the United Company uses:

- a perpetual inventory method

- a periodic inventory method

Solution:

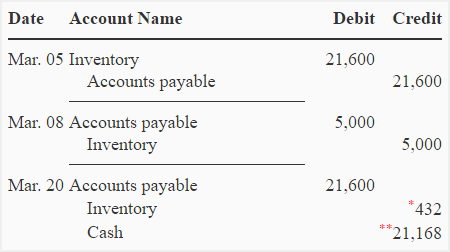

(1) Journal entries if perpetual inventory method is used:

*21,600 × 0.02 = 432

**21,600 – 432 = 21,168

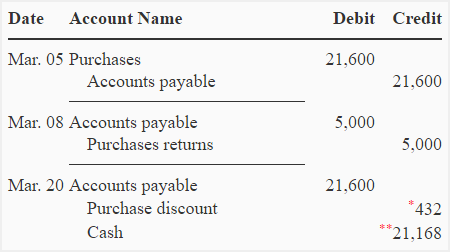

(2) Journal entries if periodic inventory method is used:

*21,600 × 0.02 = $432

**21,600 -432 = $21,168

Can you let me know why there is no difference between these 2 methods?

There is a salient difference between the two. Look at the account titles used under two methods, not just the amounts.

Am a new Accounting learn, your website really helping me a lot, am so happy to be part of this website