Exercise 5: Equivalent units, cost per equivalent unit – weighted average method

Learning objective:

This exercise illustrates the computation of equivalent units of production and cost per equivalent unit under the weighted average method.

Fedex Company produces a car care product known as Shine-9, which is a high quality vehicle cleaning liquid. The processing of Shine-9 is completed through three separate departments. The following data pertains to the company’s first processing department:

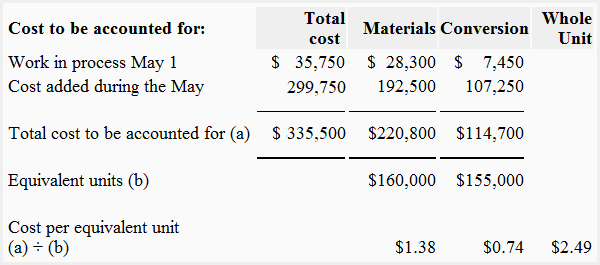

Information about the cost of work-in-process beginning inventory and the total cost added during the month of May is given below:

Work-in-process inventory on May 1:

- Materials: $28,300

- Conversion cost: $7,450

Cost added during May:

- Materials: $192,500

- Conversion cost: $107,250

Required:

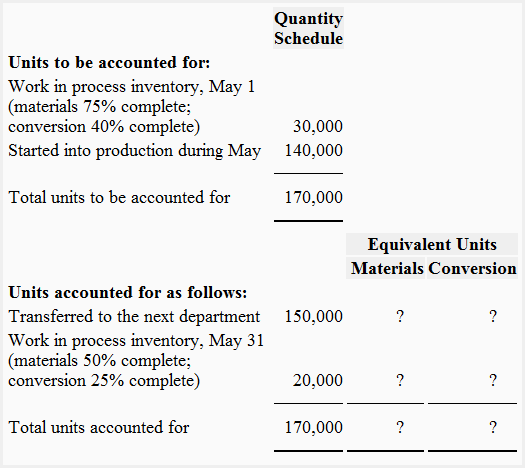

- Determine the missing figures in the above schedule. (Hint: Compute the equivalent units of production for May for the first department).

- Compute the cost per equivalent unit for May for the first department of Fedex Company.

Solution

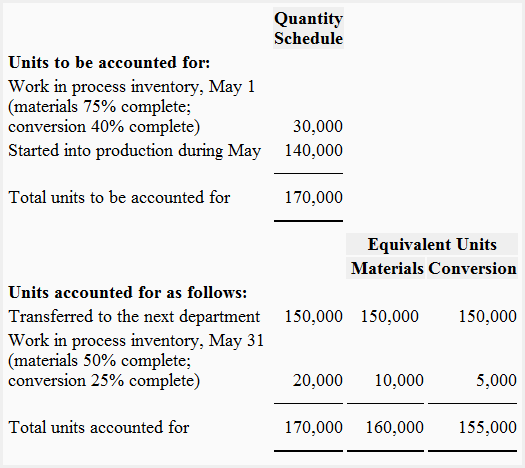

1. Missing figures (i.e., equivalent units of production):

Units transferred to the next department are considered 100% complete with respect to materials and conversion costs. The equivalent units for ending work-in-process inventory have been determined as follows:

Equivalents units in work-in-process ending inventory:

Materials: 20,000 units × 50% = 10,000 units

Conversion: 20,000 units × 25% = 5,000 units

2. Cost per equivalent unit:

Why is equivalent units (b) in dollar figures. They’re units, not dollars.