Exercise-5: Reversal cost method for by-products

Exercise-5 (a)

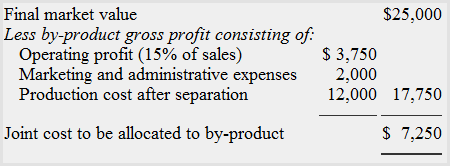

The California Company runs a manufacturing process to manufacture a main product and a by-product. The total joint production cost for December is $400,000. After split-off point, a cost of $300,000 is incurred to the complete main product and $12,000 to complete the by-product. The final market value of main product is $800,000 and the final market value of by-product is $25,000. There is no beginning and ending inventory for the month of December.

The company allocates $2,000 of marketing and administrative expenses to by-product and have a 15% operating profit of the sales price of by-product.

Required: How much cost the company should allocate to the by-product. Assume the California Company uses a reversal cost method for its by-product.

Solution

Exercise-5 (b)

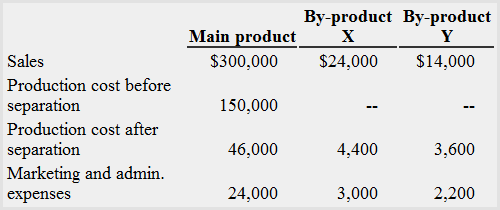

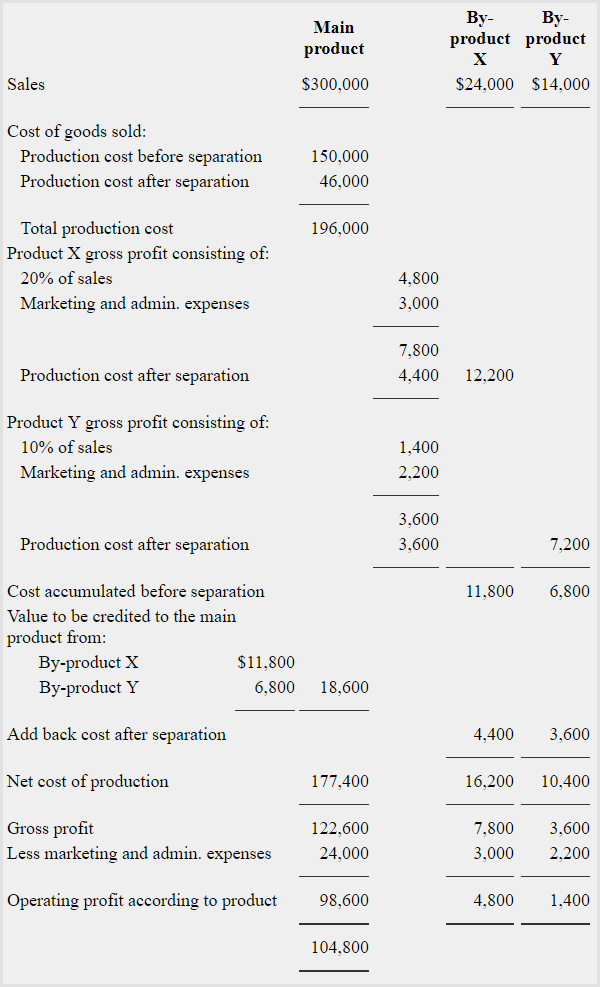

The Flowers Inc. runs a production process which results in the production of one main product and two by-products. The selected information for the month of January is given below:

There were no inventories at the start or end of January.

Required: Prepare an income statement using reversal cost method for by-products. Allow a 20% operating profit for by-product X and a 10% operating profit for by-product Y.

Solution

Leave a comment