Exercise 4: Cost per equivalent unit – weighted average and FIFO method

Learning objective:

This exercise illustrates the preparation of a quantity schedule, the computation of equivalent units of production, and the determination of cost per equivalent unit under both FIFO and weighted average methods.

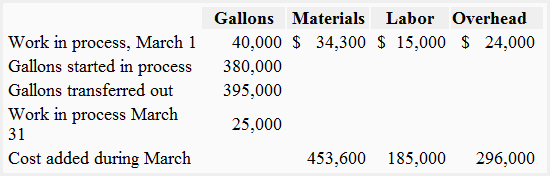

Alpha Global Inc. produces a product known as Antacid-ZX, an over-the-counter medicine used to neutralize stomach acidity. The processing of Antacid-ZX is completed in three separate departments. The data belonging to the first department for the month of March is given below:

The stages of completion of beginning and ending work in process inventories with respect to materials and processing were as follows:

Beginning work in process inventory:

Materials: 80%

Processing: 75%

Ending work in process inventory:

Materials: 60%

Processing: 20%

Required: Make a quantity schedule, compute the equivalent units of production, and determine the cost per equivalent unit, assuming Alpha uses the following methods of accounting for units and costs:

- The Weighted average method

- The FIFO method

Solution

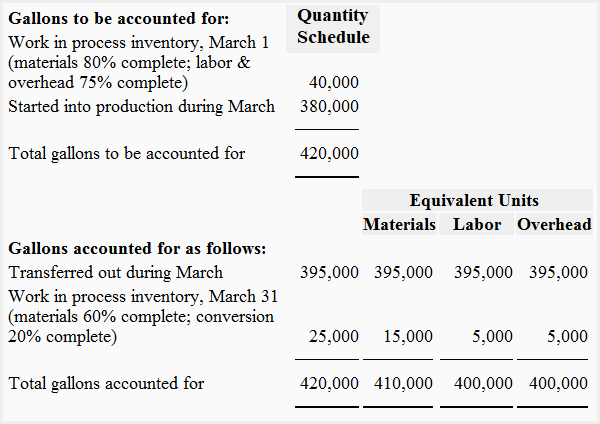

(1). Weighted average method

Quantity schedule and equivalent unit

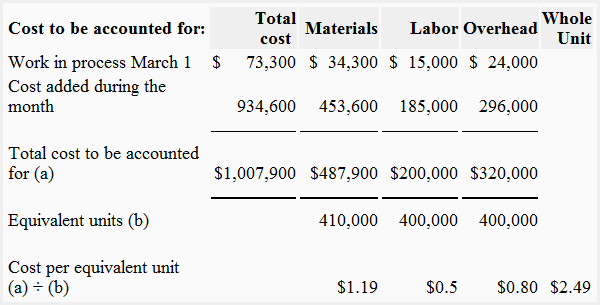

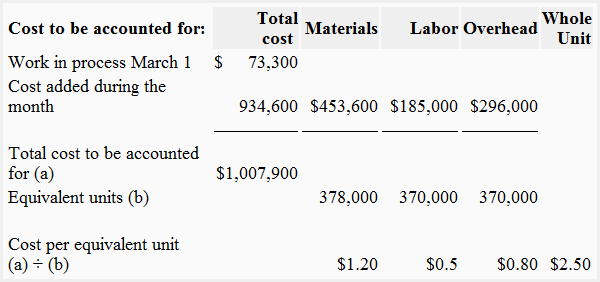

Cost per equivalent unit

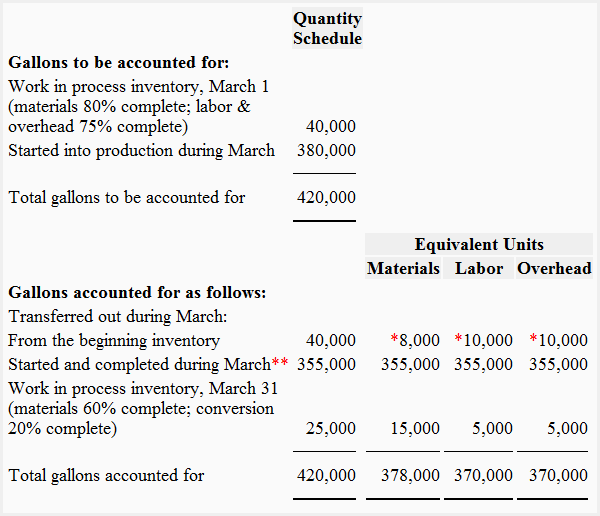

2. FIFO method

Quantity schedule and equivalent units

*Work required to complete gallons in work-in-process beginning inventory

Materials:

100% – 80% = 20%

40,000 × 20% = 8,000 gallons

Labor and overhead:

100% – 75% = 25%

40,000 × 25% = 10,000 gallons

**Started and completed during March:

= 380,000 gallons started – 25,000 gallons in work-in-process ending inventory

= 355,000 gallons started and completed during March

or

= 395,000 gallons started – 40,000 gallons in beginning work-in-process inventory

= 355,000 gallons started and completed during March

Cost per equivalent unit

Leave a comment