Exercise-4 (Ending inventory using dollar value LIFO method)

Posted in: Inventory costing methods (exercises)

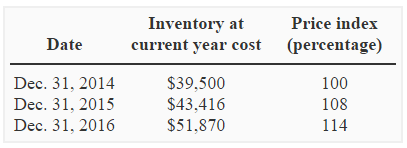

Rehan Company presents you the following data:

Required: Compute the value of inventory on December 31, 2015 and December 31, 2016 using dollar-value LIFO method.

Solution:

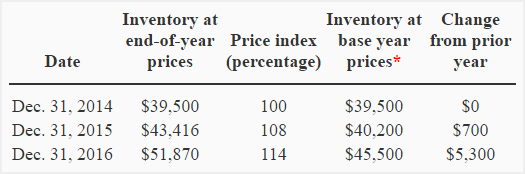

*Inventory at base year prices = Inventory at end of year prices / Price index

- December 31, 2014: $39,500/1.00 = $39,500

- December 31, 2015: $43,416/1.08 = $40,200

- December 31, 2016: $51,870/1.14 = $45,500

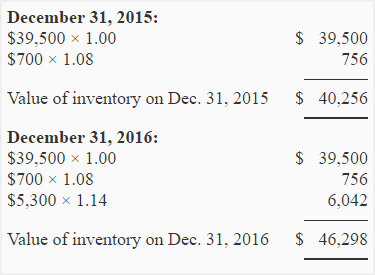

Dollar-value LIFO inventory:

Very interesting

I am very much appreciated for the help. It’s helped me a lot.

Very impressive work 🙏

Thank you very much!