Exercise-3 (Unit product cost under variable costing, break-even point)

Learning objective:

This exercise illustrates the computation of unit product cost under variable costing, preparation of income statement under variable costing and computation of break even point using contribution margin method. It also illustrates how we can arrive at absorption costing net operating income without preparing an absorption costing income statement.

Beta Company manufactures and sells large size tables to be used in executives’ offices. One table is sold for $400. The selected data for the year 2016 is given below:

Manufacturing expenses:

- Direct materials per unit: $120

- Direct labor per unit: $60

- Variable manufacturing overhead per unit: $20

- Fixed manufacturing overhead per year: $600,000

Non-manufacturing expenses:

- Variable selling and administrative expense per unit sold: $40

- Fixed selling and administrative expense per year: $900,000

Inventory information:

- Units in opening inventory: 0 units

- Units produced during 2016: 10,000 units

- Units sold during 2016: 9,000 units

- Units in closing inventory: 1,000 units

Required:

- Compute the cost of manufacturing one executive table under variable costing system.

- Prepare an income statement for Beta under variable costing system.

- Compute break even point both in units and in dollars.

- What would be the net operating income of the company under absorption costing system? Produce your answer by just preparing a reconciliation schedule. (Do not prepare an absorption costing income statement).

Solution

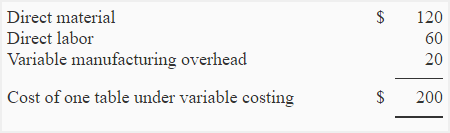

(1) Variable cost to manufacture one executive table:

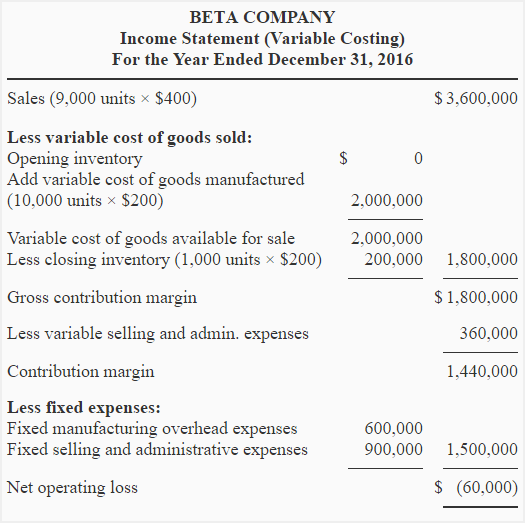

(2) Income statement under variable costing system:

(3). Break-even point:

(i), Break-even point in units:

By taking the information from variable costing income statement prepared under requirement 2, we can easily determine the break-even point using contribution margin method:

Break even point in units = Total fixed expenses/Contribution margin per unit

= $1,500,000/$160*

= 9,375 units

*Contribution margin/Units sold

= $1,440,000/9,000 Units

= $160

(ii). Break-even point in dollars:

To obtain the break-even point in dollars, we can simply multiply the break-even point in units by the per unit selling price.

Break even point in dollars = Break even point in units × Sale price per unit

= 9,375 units × $400

= $3,750,000

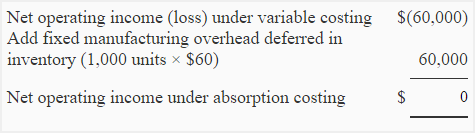

(4) Net operating income under absorption costing:

Beta’s inventory has increased during the period by 1,000 units (= 1,000 units – 0 units). When inventory increase, it defers a portion of the fixed manufacturing overhead cost to the next periods under absorption costing and, thus, reduces the cost burden of the current period. Therefore, to obtain the net operating income figure under absorption costing, the portion of the fixed manufacturing overhead cost deferred by 1,000 units of inventory to the next period would be added to the variable costing net operating income figure.

Leave a comment