Exercise-3: Joint cost allocation using weighted average method

Exercise-3 (a)

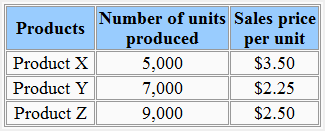

During April 2019, the Merhaba Company incurred a total joint cost of $18,250 to produce three joint products – product X, product Y and product Z. The number of units produced during April and sales price per unit at split-off point are given below:

The company uses a weighted average method for allocating joint production cost to all of its three products. For this purpose, the following weights are assigned to each unit of a product:

- Product X: 5

- Product Y: 3

- Product Z: 3

Required: Allocate the company’s joint cost for the month of April to three products using weighted average method.

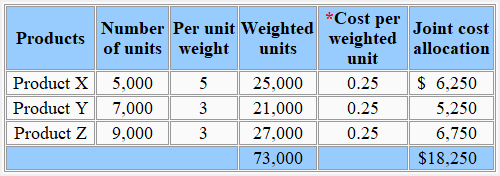

Solution

*Computation of cost per weighted unit:

$18,250/73,000

= $0.25 per weighted unit

Exercise-3 (b)

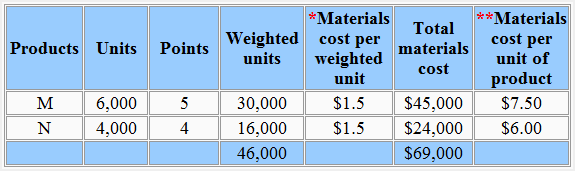

The David Company produces two products known as product M and product N. The equivalent production schedules of a department show 6,000 units of product M and 4,000 units of product N.

Both products are produced from the same raw materials but a unit of product M and product N require raw materials quantities in the ratio of 5:4 respectively.

Both products are passed through the same conversion process but a unit of product A and product B require production time in the ratio of 7:5 respectively.

Required: Calculate materials cost per unit and conversion cost per unit for both the products if total materials cost is $85,000 and total conversion cost is $36,000

Solution

Materials cost

*Materials cost per weighted unit:

$69,000/46,000 units

= $1.5 per weighted unit

**Materials cost per unit of product:

Product M: $45,000/6,000 units = $7.50

Product N: $24,000/4,000 units = $6.00

Conversion cost

*Conversion cost per weighted unit:

$49,600/62,000 units

= $0.80 per weighted unit

**Conversion cost per unit of product:

Product M: $33,600/6,000 units = $5.40 per unit

Product N: $16,000/4,000 units = $4.00 per unit

How do we get the 69000?

= Materials cost M + Materials cost N

= $45,000 + $24,000

= $69,000