Exercise-3 (FIFO, LIFO and average cost method in periodic inventory system)

Delta Company uses a periodic inventory system. The beginning balance of inventory and purchases made by the company during the month of July, 2016 are given below:

- July 01: Beginning inventory, 500 units @ $20 per unit.

- July 18: Inventory purchased, 800 units @ $24 per unit.

- July 25: Inventory purchased, 700 units @ $26 per unit.

Delta Company sold 1,400 units during the month of July.

Required: Compute inventory on July 31, 2016 and cost of goods sold for the month of July using following inventory costing methods:

- First in, first out (FIFO) method

- Last in, first out (LIFO) method

- Average cost method

Solution:

Number of units in ending inventory:

Ending inventory = Beginning inventory + Purchases made during the month – Units sold during the month

= 500 units + *1,500 units – 1,400 units

= 600 units

*800 units + 700 units = 1,500

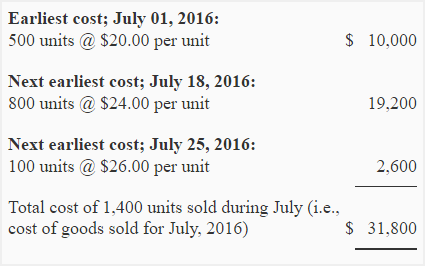

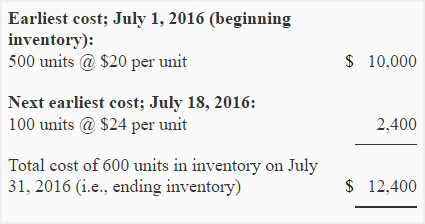

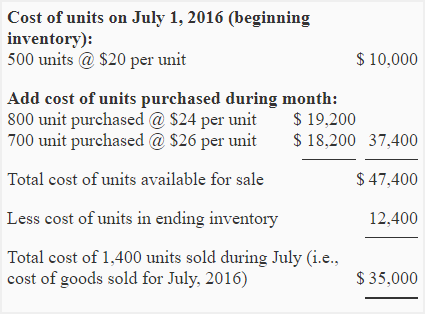

(1) First in, first out (FIFO) method:

a. Computation of inventory on July 31, 2016 ( i, e., ending inventory) under FIFO:

b. Computation of cost of goods sold (COGS) for July 31, 2016 under FIFO:

Alternatively, we can compute cost of goods sold (COGS) using earliest cost method as follows:

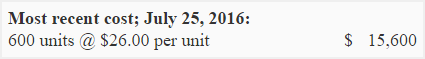

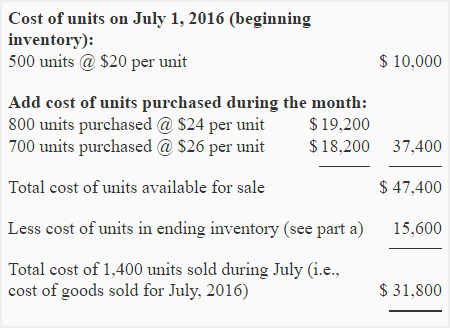

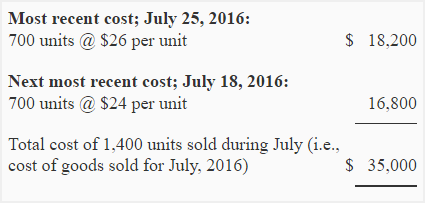

(2) Last in, first out (LIFO) method:

a. Computation of inventory on July 31, 2016 ( i, e., ending inventory) under LIFO:

b. Computation of cost of goods sold (COGS) for July 31, 2016 under LIFO:

Alternatively, we can compute cost of goods sold (COGS) using most recent cost method as follows:

(3) If average cost method is used:

[(500 units × $20) + (800 units × $24) + (700 units × $26)]/500 units + 800 units + 700 units

= $47,400/2,000 units

= $23.70

a. Computation of inventory on July 31, 2016 ( i, e., ending inventory) under average cost method:

Ending inventory = 600 units × $23.70

= $14,220

b. Computation of cost of goods sold (COGS) for July 31, 2016 under average cost method:

Cost of goods sold (COGS) = 1,400 × $23.70

= $33,180

Alternatively, we can compute cost of goods sold (COGS) by deducting ending inventory from the cost of goods available for sale:

Cost of goods sold (COGS) = Cost of goods available for sale – Ending inventory

Cost of goods sold (COGS) = [{(500 units × $20) + (800 units × $24) + (700 units × $26)} – $14,220*]

= $47,400 – $14,220

= $33,180

*See part a

I would appreciate your teaching online, I enjoyed it.. I really need a table for clear understanding..

Thanks 👍 for the lessons.

Kindly email me more examples with solutions

Thanks 👍 for the lessons.

Kindly email me more examples with solutions

Thank you

that is amazed

Thanks 👍 for the lessons.

Kindly email me more examples with solutions

Thank you very much how to explained and teach me ,this lesson.

Thanks