Exercise-2: Net cash provided/used by investing activities

Posted in: Statement of cash flows (exercises)

Learning objective:

This exercise illustrates the computation of cash provided (or used) by investing activities and its reporting on the statement of cash flows.

Exercise-2(a):

Big and Fast Company provides the following information about its activities during the year 2023:

- Marketable securities purchased: $45,000

- Treasury stock purchased: $56,000

- Inventory purchased: $412,000

- Land sold: $95,000

- Machinery purchased: $278,000

- Common stock issued: $168,000

Required: Compute the net cash provided (or used) by investing activities to be reported in the statement of cash flows of Big and Fast Company.

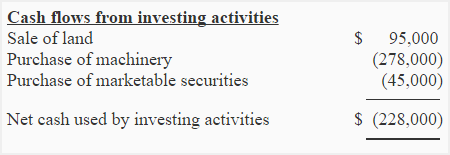

Solution:

Note: The following activities have not been included in the above computation because they are not investing activities.

- Purchase of treasury stock – a financing activity.

- Purchase of inventory – an operating activity.

- Issuance of common stock – a financing activity.

Exercise-2(b):

P&G Company provides the following information for the year 2024:

- Old plant asset sold for $164,000; the gain on sale was of $5,000

- Treasury stock purchased for $42,000

- Investment purchased for $25,000

- A new plant asset purchased for $115,000

- Common stock issued for $375,000

Required: Compute the net cash provided (or used) by investing activities for P&G using the above information.

Solution:

Notes:

- Proceeds from sale of old plant asset includes a gain of $5,000.

- The purchase of treasury stock and the issuance of common stock have been ignored because they are not investing activities.

That’s example of accounting exercise, I’m much appreciated. Thanks

Excellent