Exercise-2: Distribution of service department expenses using step down method

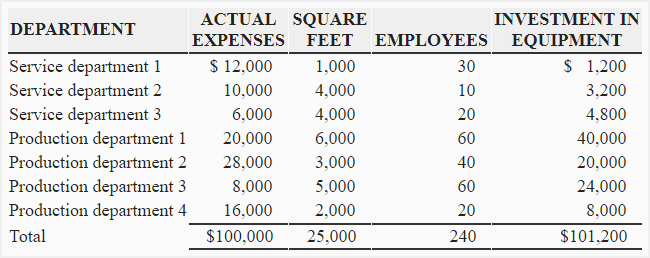

SK Company has three service departments and four production departments. The information for the month of November is given below:

SK Company uses the following order and bases for the allocation of service department expenses to production departments:

- Service department 1; allocation base is “square feet of area occupied”.

- Service department 2; allocation base is “number of employees”.

- Service department 3; allocation base is “investment in equipment”.

Required: Distribute the expenses of service departments on the basis of above information using step down method.

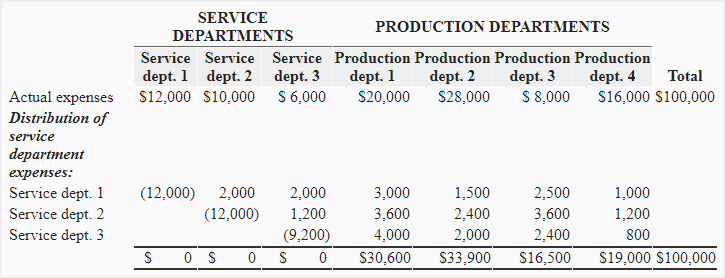

Solution

Under step down method of cost allocation, the cost of a service department is allocated to other service departments as well as to production departments; however once a department’s expenses have been allocated, no expenses are assigned back to it.

Computation of distribution rates:

The distribution rates for service departments are computed by dividing distributable expenses of each service department by the applicable allocation or distribution base. The distributable expenses of a service department are equal to the actual expenses incurred by the department plus any expenses of other service departments allocated to it.

Service department 1:

Expenses to be distributed: $12,000

Distribution rate: $12000/24,000 sq ft.* = $0.5 per sq ft.

*4,000 + 4,000 + 6,000 + 3,000 + 5,000 + 2,000 = 24,000 square feet

Service department 2:

Expenses to be distributed: $10,000 + $2,000 = $12,000

Distribution rate: $12000/200 employees* = $60 per employee

*20 + 60 + 40 + 60 + 20 = 200 employees

Service department 3:

Expenses to be distributed: $6,000 + $2,000 + $1,200 = $9,200

Distribution rate: $9,200/$92,000* = $0.1 per dollar of investment

*$40,000 + $20,000 + $24,000 + $8,000 = $92,000

Leave a comment