Exercise-2: By-product costing and journal entries

Robert company produces a product known as chemical X. In the production of chemical X, a by-product results which has a market value of $0.30 per litre at split-off point. The company is able to sell the by-product as is for $0.30 per litre or process it further and sell for $0.70 per litre.

If the company opts for additional processing of by product, the following materials, labor and factory overhead costs are required per liter of by-product:

- Materials: $0.12

- Labor: $0.20

- Factory overhead: $0.18

During the month of March 2019, 190,000 liters of chemical X and 30,000 liters of by-product were produced. The production cost of chemical X at the the point of separation were as follows:

- Materials: $250,000

- Labor: $200,000

- Factory overhead: $71,100

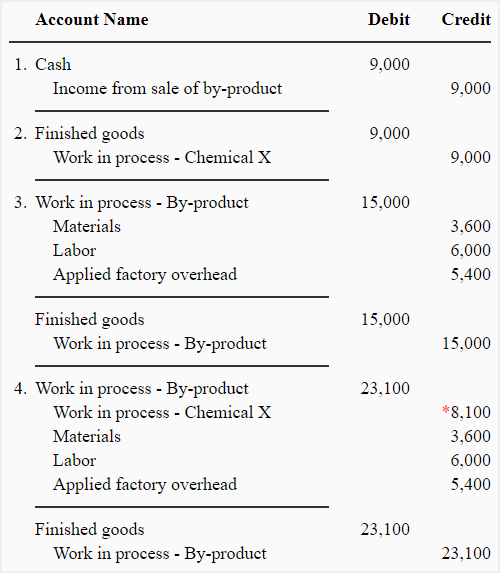

Required: Make journal entries for by-product when:

- the by-product is stored without allocating it any cost and later sold to customers at $0.30 per liter without additional processing and without incurring any cost.

- the by-product is stored and costed at $0.30 per liter, reducing the cost of chemical X (i.e., main product) by the amount assigned to it.

- the by-product is processed further and stored without allocating it any cost prior to separation.

- the by-product is processed further and stored. The cost prior to separation is allocated to it using the market value method at split-off. The cost of the chemical X (i.e., main product) is reduced by the amount allocated to the by-product. The market value of chemical X is $3.

Solution

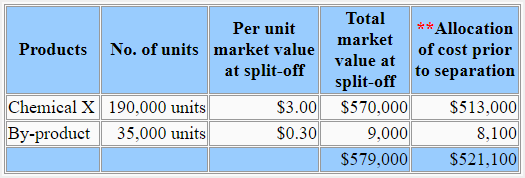

*Allocation of cost prior to separation (joint cost) using market value method at split-off point:

Total cost prior to separation:

$250,000 + $200,000 + $71,100

= $521,100

**The cost prior to separation (joint cost) is 90% of total market value at split-off point as computed below:

$521,000/$579,000

= 0.9 or 90%

Leave a comment