Exercise-2 (Perpetual and periodic inventory system – journal entries)

The beginning inventory of Beta Company consisted of 100 units @ $60 each. The following transactions occurred during the month of March 2023.

- Mar. 05: Purchased 300 units @ $60 each.

- Mar. 06: Out of 300 units purchased on March 05, 10 units were returned to supplier.

- Mar: 28: Sold 250 units @ $100 each.

On March 31, 2023, 140 units were found by a physical count.

Required: Make journal entries for the month of June assuming the Beta company uses:

Solution:

(1) If perpetual inventory system is used:

March 05 – entry to record purchase of 300 units on account:

*(300 units × $60) = $18,000

March 06 – entry to record return of 10 units to supplier:

*(10 units × $60) = $18,000

March 28 – entries to record sale of 250 units to customers:

a. Entry to realize sales revenue:

*(250 units × $100) = $25,000

b. Entry to update inventory account:

*(250 units × $60) = $15,000

(2). If periodic inventory system is used:

March 05 – entry to record purchase of 300 units on account:

March 06 – entry to record return of 10 units to supplier:

March 28 – entry to record sale of 250 units to customers:

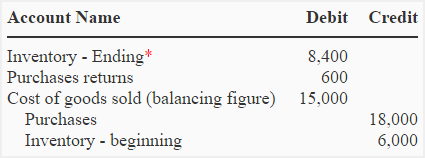

March 31 – closing entry to create cost of goods sold account and to update inventory account :

*140 × $60 = 8,400

very helpful, thank you.