Exercise-15: Comparison of two projects using net present value (NPV) method

Learning objective:

This exercise illustrates the basic NPV comparison of two projects with equal lives.

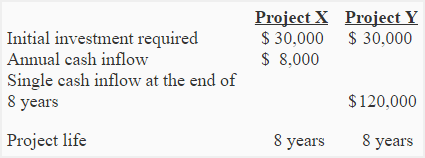

Wellness Company is trying to choose the best investment project from two alternative projects. The company has $30,000 to invest. The information about two alternatives is given below:

The discount rate of Wellness company is 15%.

Required: Give your recommendation to the company in selecting the best project to invest $30,000. Use net present value (NPV) method for your answer.

Solution:

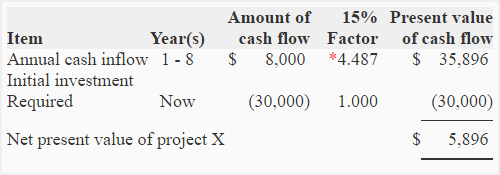

Net present value (NPV) of project X:

*Value from present value of annuity of $1 in arrears table.

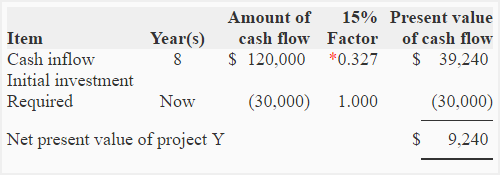

Net present value (NPV) of project Y:

**Value from present value of $1 table

Recommendation:

Project Y’s net present value is $9,240 which is more than project X’s net present value. Project Y is therefore, more desirable.

Alternatively, we can compute the profitability index of both the projects as follows:

Profitability index = Present value of cash inflows/Investment required

- Project X: $35,896/$30,000 = 1.195

- Project Y: $39,240/$30,000 = 1.308

We can see that the profitability index of project Y is higher than project X. Project Y is therefore preferred over project X.

Leave a comment