Exercise-11 (Comparison of FIFO, LIFO and average costing method)

The president of HPL Inc. wants to know the effect of different inventory costing methods on the financial statements. For the purpose of comparison of some popular inventory costing methods, the following data was selected.

- Cash balance on January 1, 2023: $14,000.

- Retained earnings January 1, 2023: $20,000.

- Inventory on January 1, 2023: 8,000 units @ $6.

- Income tax rate: 30%.

The HPL Inc. sold 10,000 units for $240,000 during the year 2023. The total purchases were 12,000 units @ $8 each and the total operating expenses were $25,000 during this period. A periodic costing method is used.

Required:

- Prepare a comparative income statement using FIFO, LIFO and average costing method to show the effect of each on net operating income of HPL Inc.

- Show the balances of the following items on December 31, 2023 under FIFO, LIFO and average costing method:

(i). Inventory

(ii). Retained earnings

(iii). Cash

Solution:

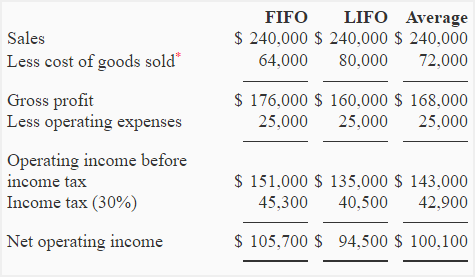

(1). Income statement under FIFO, LIFO and average costing method:

*Cost of goods sold:

- FIFO method: (8,000 units × $6) + (2,000 units × $8) = $64,000

- LIFO method: (10,000 × $8) = $80,000

- Average method: 10,000 × [($96,000 + $48,000) / 20,000] = $72,000

(2). The ending balances of inventory, retained earnings and cash:

Units in ending inventory = Units in beginning inventory + Units purchased – Units sold

= 10,000 units + 12,000 units – 10,000 units

= 10,000 units

FIFO method:

i. Inventory:

= 10,000 units × $8

= $80,000

ii. Retained earnings:

= $20,000 + $105,700

= $125,700

iii. Cash:

= Beginning balance + Sales – Purchases – Operating expenses – Income tax

= $14,000 + $240,000 – $96,000 – $25,000 – $45,300

= $87,700

LIFO method:

i. Inventory:

= (2,000 units × $8) + (8,000 units × $6)

= $64,000

ii. Retained earnings:

= $20,000 + $94,500

= $114,500

iii. Cash:

= Beginning balance + Sales – Purchases – Operating expenses – Income tax

= $14,000 + $240,000 – $96,000 – $25,000 – $40,500

= $92,500

Average costing method:

(i). Inventory:

= 10,000 units × $7.2*

= $72,000

*($96,000 + $48,000)/20,000 units

(ii). Retained earnings:

= $20,000 + $100,100

= $120,100

(iii). Cash:

= Beginning balance + Sales – Purchases – Operating expenses – Income tax

= $14,000 + $240,000 – $96,000 – $25,000 – $42,900

= $90,100

Nice