Difference between service and operating departments

The departments are categorized as either operating departments or service departments. The operating departments carry out the central purposes of the organization. This central purpose is the transformation of raw materials or assembling the parts into finished goods in a manufacturing organization and the provision of services to clients in a service organization.

The service departments, on the other hand, do not directly engage in manufacturing goods or providing services to clients; rather, they provide services to operating departments of the same organization. They are established with the objective to serve and facilitate the operating departments of the organization in performing their functions smoothly and efficiently.

The large business organizations usually have both types of departments.

Examples of operating and service departments

Examples of operating departments

Some examples of operating departments are given below:

- Cutting department

- Milling department

- Assembling department

- Knitting department

- Planing department

- Painting department

- Upholstery department

- Mixing department

- Finishing department

- Refining department

- Matching department

- Surgery department at a hospital

- Geography department at a university

Examples of service departments

Some examples of service departments are given below:

- Material handling department

- Medical department

- Inspection department

- Security department

- Maintenance department

- Cafeteria

- Human resource department

- Purchasing department

- Internal auditing department

- Storage department

- Accounting department

- Shipping department

- Production control department

- Receiving department

Allocation of service department costs to operating departments

Selection of an allocation base

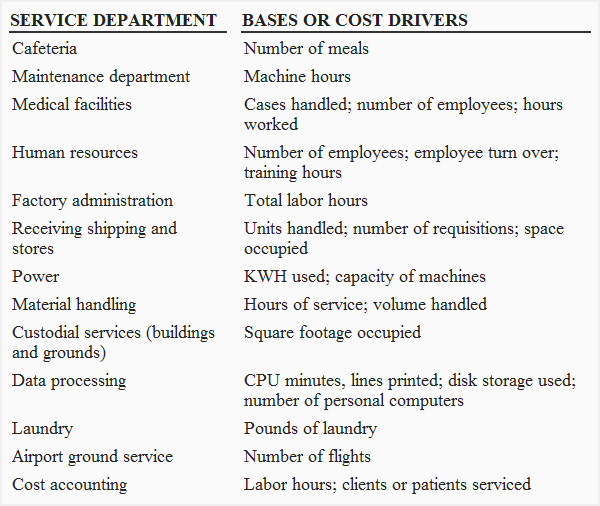

In most organizations the costs incurred by service departments are allocated to operating departments using an appropriate allocation base. The allocation base selected for allocating the cost of a particular service department should drive the cost of that department. An increase or decrease in the total cost incurred by a service department should be directly proportional to the increase or decrease in the allocation base. For example, an appropriate allocation base for allocating the cost of cafeteria is the number of meals served because the costs incurred in cafeteria during a period largely depends on the number of meals served during that period.

Managers often suggest that the allocation base should also reflect the benefit that each department receives from a particular service department. For example, the space occupied by each department may be used as the basis for allocating janitorial services to them.

Allocation methods

There are various methods for allocating service department costs to operating departments. However, the three commonly used methods are direct method, step down method and reciprocal method. We have illustrated each method on a separate page. Click on the next link below to start with the direct method.

Leave a comment