Depreciation tax shield

Definition and explanation

Depreciation tax shield refers to the net reduction in a company’s income tax liability on account of annual depreciation charge admissible under the applicable tax law. A company can estimate the amount of available tax shield by multiplying its tax admissible depreciation by the applicable tax rate.

The depreciation tax shield works well in asset-intensive companies, like the ones involved in manufacturing, processing, transportation and telecommunication businesses. These companies generally operate through a lot of noncurrent assets on which a large amount of depreciation can be calculated and deducted from taxable income. The service organizations, on the other hand, need only a few fixed assets to run their operations. In these organizations, the amount of annual depreciation charge is generally immaterial, and hence the amount of resulting tax shield.

The concept of depreciation tax shield would not be relevant in a country, state or province whose tax jurisdiction does not permit companies to use depreciation as a tax admissible expense.

Formula

If a company’s annual tax deductible depreciation is known, we can simply multiply it with the company’s applicable tax rate to obtain the amount of available tax shield. The formula or equation of depreciation tax shield can be written as follows:

Depreciation tax shield = Tax admissible depreciation x Applicable tax rate

Example

Fantom, an oil refining firm, has an aggregate annual tax deductible depreciation of $9,000,000. What amount would be available as annual tax shield to Fantom on account of its allowable depreciation if the applicable tax rate is 27%, 37% and 50%?

Solution

(1). Annual DTS available at 27% tax rate:

= $9,000,000 x 0.27

= $2,430,000

(2). Annual DTS available at 37% tax rate:

= $9,000,000 x 0.37

= $3,330,000

(3). Annual DTS available at 50% tax rate:

= $9,000,000 x 0.50

= $4,500,000

Notice that the amount of tax shield increases as the tax rate increases. This is because, at 27%, 37% and 50% tax rates, every dollar of depreciation expense saves Fantom 27 cents, 37 cents and 50 cents in income tax, respectively.

Similarly, the depreciation tax shield increases as the amount of allowable depreciation increases. Suppose, in above example, if Fantom’s annual tax admissible depreciation increases from $9,000,000 to $10,000,000, then the available tax shield at given tax rates would increase to $2,700,000, $3,700,000 and $50,000,000, respectively.

So, conclusively, we can say that the concept is more practical and effective when the annual depreciation expense and tax rates are higher.

Depreciation tax shield with accelerated depreciation

To optimize the benefit of depreciation tax shield, companies should consider the use of an accelerated depreciation approach to depreciate their fixed assets. The reason is that, this technique provides a larger depreciation as tax deductible expense in early years of asset’s economic life and less depreciation in later years. Accelerated depreciation is a tool for taxpayers to defer the payment of income tax until some later years by deferring the recognition of a portion of taxable income.

A tax jurisdiction, however, may not allow the use of accelerated depreciation for tax returns purpose. In that case, companies use straight line depreciation which generally limits the impact of tax shield that could result from depreciation.

Commercial entities extensively tend to outsource their tax returns task to tax firms. These independent tax firms keep themselves update to deal with all tax related matters and have special expertise in preparing tax returns for almost all types of companies and individuals. They evaluate all permissible depreciation methods and choose the one that results in maximum depreciation tax shield for the tax returns of their client company.

For financial reporting, organizations generally prefer a simple and straight forward depreciation approach to make their closing process easier and faster. A general example of such approach is the use of traditional straight-line method.

Depreciation tax shield in net present value (NPV) calculation

We know that the depreciation itself is a non-cash expense. However, when it is deducted from taxable income, it has a positive cash flow effect in the form of tax saving – the depreciation tax shield. In capital budgeting, the amount available as depreciation tax shield can be treated as equivalent to either reduced cash outflow or increased cash inflow.

Depreciation tax shield can dramatically impact the NPV of a proposed project, especially when the company’s tax rate is higher and the project involves the use of costly fixed assets. Let’s illustrate how depreciation tax shield works with NPV calculation.

Example

Alfa Manufacturing Company is considering to purchase a new machine to upgrade its existing manufacturing process. An initial investment of $2,000,000 is needed to purchase and install the new machine in the system. The machine will remain useful for a period of 10 yeas and will have a salvage value of $100,000. The expected net annual cash inflow associated with this upgradation is $650,000. The tax jurisdiction requires companies to use the straight-line method of depreciation for tax returns. The salvage value of the machine will not be considered while computing the depreciation for tax purpose. Alfa’s tax rate is 32% and its cost of capital is 15% which it applies to discount all future cash flows.

Required:

- Calculate the net present value (NPV) of the machine.

- Will it make a difference if tax authorities don’t allow Alfa to deduct depreciation from its taxable income?

Solution:

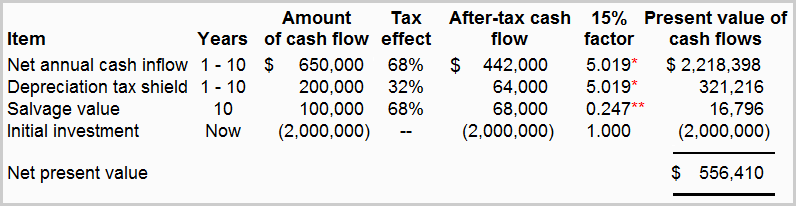

(1). NPV with depreciation tax shield:

* Value from present value of an annuity of $1 in arrears table.

** Value from present value of $1 table.

(2). NPV without depreciation tax shield:

Of course it will make a difference because, at the current 32% tax rate, each dollar in tax deductible depreciation saves the company 32 cents in taxes, a benefit to the company. If depreciation is not allowed as tax deductible expense, the depreciation tax shield will not be available to Alfa, and in that case, the NPV in our solution will reduce from $556,410 to $235,194 as computed below:

NPV without tax deductible depreciation = NPV with tax deductible depreciation – Depreciation tax shield

= $556,410 – $321,216

= $235,194

Leave a comment