Depreciation is a process of cost allocation, not valuation

In accounting, the term depreciation refers to the allocation of cost of a tangible asset to expense to the periods in which the asset is expected to be used to obtain the economic benefit. For example, a company purchases a piece of equipment for $20,000 and estimates that the equipment will be used for a period of 10 years. The cost of the equipment (i.e., $20,000) will be allocated to each of 10 years using some systematic and rational allocation method.

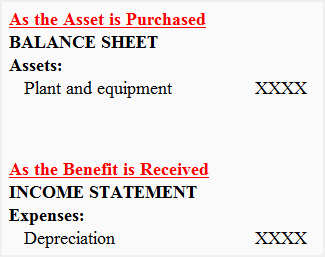

The cost of an asset is initially recorded as an asset in accounting records because the asset will be used for many periods in future. Afterwards, the portion of cost that is allocated to a particular period is removed from the total cost of the asset by means of an adjusting entry. It becomes the expense of that particular period and is matched against revenue like any other expense.

The concept explained above can be summarized as follows:

Adjusting entry for recording depreciation expense:

Depreciation expense [Dr]

Accumulated depreciation – plant and equipment [Cr]

Balance sheet presentation:

Leave a comment