Declining balance method of depreciation

The declining balance method is a widely used form of accelerated depreciation in which some percentage of straight line depreciation rate is used. This method essentially results in more depreciation charge in early years and less depreciation charge in later years of asset’s useful life. A usual practice is to apply a 200% or 150% of company’s straight line depreciation rate to calculate and apply the depreciation expense for the period. The depreciation rate that is determined under such an approach is known as declining balance rate or accelerated depreciation rate. For example, if straight line depreciation rate is 10% and the company uses a 200% of the straight line depreciation rate, the accelerated depreciation rate to be used in declining balance method would be 20% (= 10% × 2).

Unlike other depreciation methods, the salvage value is not deducted from the cost of the asset under this method. The accelerated depreciation rate is applied to the book value (i.e., undepreciated cost) of the asset at the beginning of the period. The continuous charge reduces the book value of the asset year by year and, hence, the depreciation expense. When book value of the asset reduces to its salvage value, no more depreciation is provided.

The declining balance method is often applied to provide depreciation on those assets that become obsolete quickly – generally within a few years of their purchase. Small high tech assets like mobile phones, computer components, equipment and peripherals are good examples of such assets. They generally lose their value quickly as newer or more efficient models become available in the market.

Double declining balance method:

The double declining balance method is simply a declining balance method in which a double ( i.e., 200%) of the straight line depreciation rate is used – also discussed in first paragraph of this article.

Formula:

The first step in declining balance method is to calculate a straight line depreciation rate, that is calculated using the following formula:

Straight-line depreciation rate = 1/Useful life of the asset

After calculating straight line rate, the accelerated depreciation rate is calculated to be used in the declining balance method. It is calculated using the following formula:

Accelerated depreciation rate = straight-line depreciation rate × Specific percentage

Finally, the depreciation expense is calculated using the following formula:

Depreciation expense = Remaining book value × Accelerated depreciation rate

Let’s take an example for better understanding of declining balance method.

Example:

Alfa Company has recently acquired a piece of computer equipment. The company provides you the following information:

- Cost of the equipment: $500,000

- Salvage value: $50,000

- Useful life: 5 years

Required: Prepare a depreciation schedule for five years using double declining balance method of depreciation.

Solution:

Step 1 – Straight-line depreciation rate:

1/5 = 0.2 or 20%

Step 2 – Declining balance rate (accelerated depreciation rate):

20% × 2 = 40%

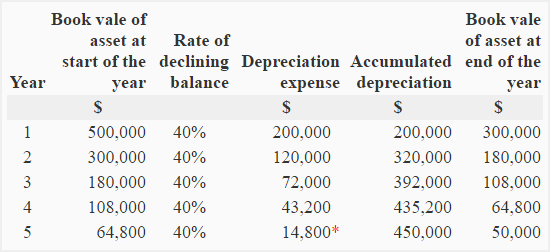

Step 3 – Calculation of depreciation expense and preparation of schedule:

* The book value of the equipment at the beginning of year 5 is $64,800 whose 40% is $25,920. If this depreciation is used, the book value of the equipment at the end of year 5 will be $38,880 (= $64,800 – $25,920) which is less than its salvage value. As stated earlier, an asset is depreciated only to its salvage value under declining balance method. The depreciation on equipment for year 5 has, therefore, been computed as follows:

= Book value at the beginning of the year 5 – Salvage value of the asset

= $64,800 – $50,000

= $14,800

Is it the same as the reducing balance method